In a previous post, I cajoled Mr. Trump for his public excoriation of our Fed, yet there is a case for lower interest rates and in a big way. The primary reason is that the yield curve is inverted, and it has been for quite a bit of time. While I have previously argued that no one knows what the interest rate should be, especially the Fed, I have suggested that since the market is a price we ought to let the market decide what the price of money is–just like the markets should decide every other price. After all, markets reflect the underlying preferences of billions of people; when markets reflect those preferences we are maximizing social welfare (at least as those market participants would see it*).

Yet markets have called for such an interest rate cut already, since the spring time. As you can see from Treasury data, the yield curve has been flat since Mar, then inverted most days since May, as short term 3 month rates are higher than the 10-year treasury. This is the usual harbinger (some say the cause) of recession. Our whole financial system is based on the “borrow short, lend long” model, and that requires a positive sloping yield curve. A negative sloping yield curve is unnatural, absent extreme events, and is caused by central banks. The typical inverted curve is always the result of the monetary authority keeping money too loose, too long, and inflation perking up, and then the monetary authority has to raise short term rates to cool off the mess they’ve created. Our current Fed still has painful memories of what it unleashed in the 1970s.

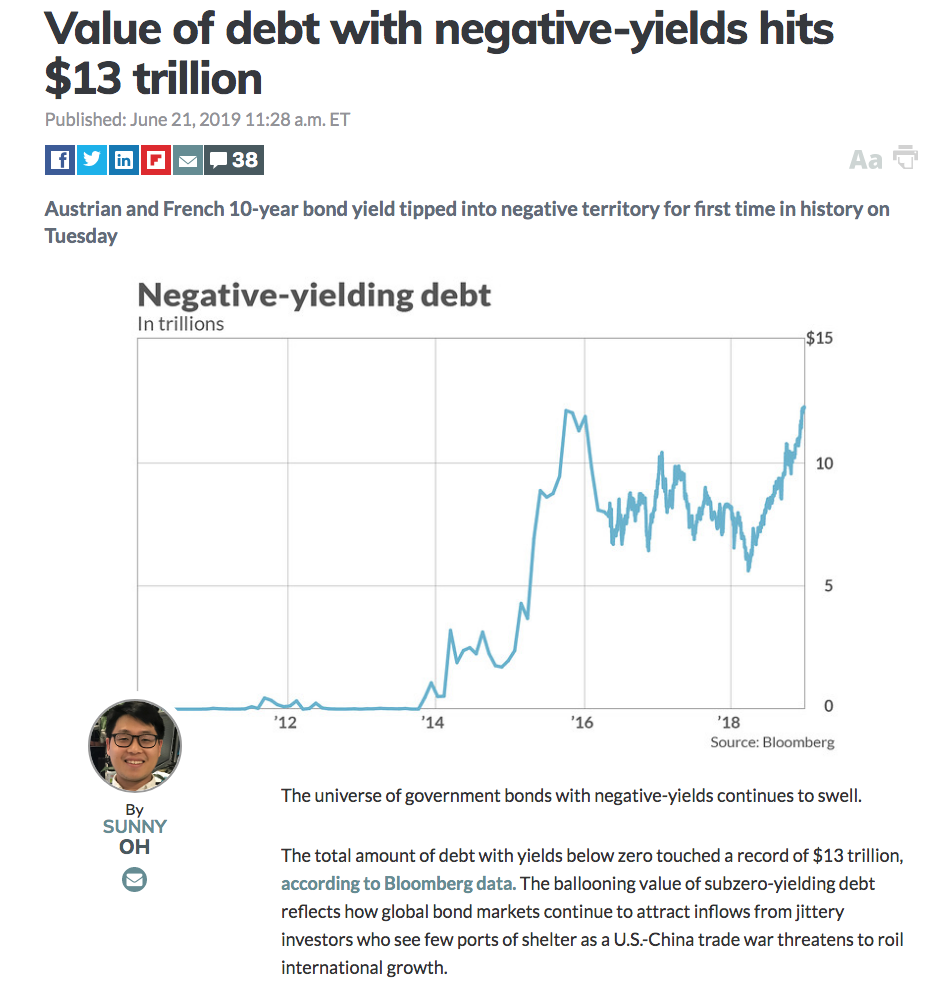

So with the low inflation rates we have, and the modest reduction in stimulus over the last year, why would markets think the Fed is too tight and keeping our interest rates too high? Mr. Trump is right to blame the monetary authorities–he’s just blaming the wrong ones. We live in a global financial economy, and the European Central Bank (ECB) and the Bank of Japan (BOJ) (among others) are creating a world of negative nominal interest rates–something unheard of prior to this decade. We currently have ~$13T in global bonds yielding negative rates–savers are paying someone for the “privilege” of loaning them money!

There is something dramatically wrong when US interest rates are higher, much higher, than most of our “competitors”, and near equal profligates such as Italy!** Mr. Trump has seen this, and is upset that our trading partners have an easier time and that he is having to fight monetary headwinds. And he has a point. Our interest rates are still very low in absolute terms, and even in real terms. But not in relative terms–relative to the other members of the global financial system. But his target should not be our Fed–his target should be the ECB and the BOJ. What is the answer? Mr. Trump has called for it before, and his intuition is right even if he doesn’t really appreciate the economics–he should be leading the way for global monetary stability through a gold standard. That the Fed just took the wrong position is argued by the spike in the dollar price of gold recently. Yet in many foreign currencies, gold is hitting new highs–suggesting that these other currencies should be raising, not lowering their rates. Rather than a global coordinated negative interest rates, we should have a market based money (e.g., gold) that would lead to a normalization of interest rates. No time to comment today on this, but Mr. Trump’s pick of Judy Shelton for the Fed is a good one, but that’s why I suspect she probably won’t make it. As one Forbes commentator said,

In the end, the practical choice boils down to the Gold Standard, or the “PhD Standard.” If your money isn’t based on gold, it will be based on the variable opinions of people bearing PhDs. One has always worked; one has never worked; and I think most Americans already understand this pretty well.

*Obviously there are a whole host of goods and services in markets that while satisfying an immediate desire are actually harmful to society–certainly over the long term. Pricing of cigarettes much higher than the market price through government taxation is arguably socially beneficial, and we should argue that some goods and services should not have markets at all (e.g., sex trafficking).

** The U.S. is pretty profligate, but we’re still the world’s cleanest dirty shirt.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach