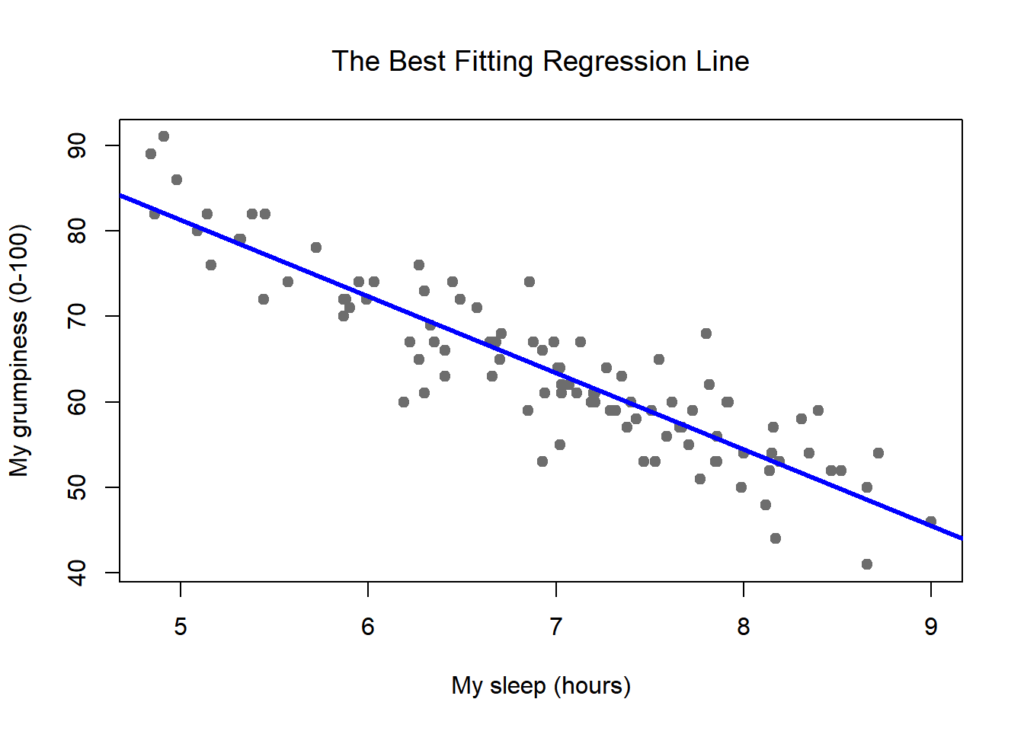

I’ll continue to provide updates on the market and economy from my perspective here at BATG, but the purpose of this post is to point out why the uncertainty of prognostications about the future are much larger than normal times. In short, we have no history to draw on for the Federal Reserve dropping $5T in the economy (over doubling the assets on their balance sheet) in such a short time. Consider this figure found on the internet to explain a relationship between sleep and grumpiness:

In this example we have a lot of data points (nights of sleep) for an individual, and not surprisingly, when this person got five hours of sleep he was much more grumpy (on his grumpiness assessment, however done) than if he had eight or nine hours sleep. The point of this online example was to show how we statistically determine this relationship, using a technique known as Ordinary Least Squares (OLS). The relationship we see in the scatterplot is “best fit” by the blue line going through the data, as it minimizes the distance between the points and is our best understanding of what the true underlying relationship is, given the data we have. Now the point of this post is most certainly not to teach you statistics, but to point out something that will be intuitive to most people. At best, this relationship between hours of sleep and this individual’s grumpiness (the blue line) is only valid for the range of hours we see in the sample data. In other words, we might see grumpiness go back up if we had 15 hours of sleep; he might be so lethargic that he’d be worthless for that day. Or two hours sleep might equivalently lead us to about 85 on the grumpiness scale–we may never get more grumpy once we get below a certain point. We don’t know, because we have no experience (and data) outside the range in the chart.

So it is with the current economy. Milton Friedman’s brilliant monetary treatise (w/Anna Schwartz) never records any history of such monetary malpractice as what the Federal Reserve has done over the two years from the initial Covid response. We know a lot of the money injected into the economy is still there, a lot of so-called dry powder is available for financial markets to draw from, household balance sheets are still very strong, and yes, there are jobs for people that want them. So as I relate my expectations about the future direction of the economy, there is a lot more murkiness about how the Fed will manage this cycle. We’ve never been here before. Nevertheless, we are not blind and sound economic theory helps us navigate the uncertain waters of the future. Stay tuned; I’ll have a new post out tomorrow sharing the latest update on the Federal Reserve monetary data, and we’ll talk about Friday’s market drubbing. But hopefully this short post makes us all a bit more trepidatious about the specific path ahead.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach