In response to higher gas prices, Elizabeth Warren is proposing a windfall profit tax on large oil companies, whose “greed” is exploiting an international crisis. Economics has this nasty little way of bringing reality into the conversation, as supply and demand will both have their day. Progressive hostility to fossil fuels, which has accelerated during the Biden Administration, has been a large part of decreased investment in fossil fuel development, and this proposal would only accelerate that trend. As oil prices fell last year with the pandemic, for some reason these progressives had no problem with big oil eating the losses, but when the reverse is true, now that’s completely out of bounds, as Ms. Warren tweeted Thursday:

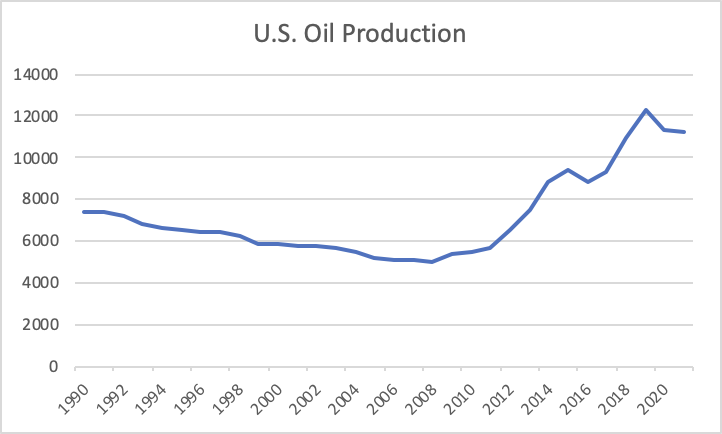

It’s unfortunate that these Senators (and members of the House who have a similar approach) fail to understand economics and the social purpose of profits. Profits that are above normal are a signal that either the current market is being underserved in terms of quantity (think amount of oil produced in this case), or underserved in terms of quality (think about Apple’s profit level compared to other computer or phone makers). For either case, it is a signal to the rest of the market to “do more of what these firms are doing!” And in the old farming adage, make hay while the sun is shining. Higher profits encourage reinvestment into production capacity, which is exactly what we need right now. Our problem is not excessive demand, our problem is that for a whole bunch of reasons (to include Russia but also bad policies) we are not producing as much oil and gasoline as we need. Confiscating these profits simply takes the capital out of the hands of those that could help increase supply, and puts it into the hands of those that refuse to increase our supply–the politicians. Ironically, it is precisely higher profits that would enable big oil to reinvest also in alternative energy futures; this tax would delay some of the investments companies like Shell have pledged to do to transition to a more sustainable energy model.

Not to be outdone, Mr. Biden took the lead to call higher gas prices “Putin’s Price Hike”, as if higher prices only emerged with the invasion of Ukraine. But what is he supposed to do? Tell the truth? We’ve covered this repeatedly for the last year, but his administration insisted that trillions of new spending were required after his election, and stubbornly suggested that no economist would think this is inflationary, and his regulatory onslaught against fossil fuels began with killing the Keystone Pipeline on Day One of his administration. While the Federal Reserve is ultimately responsible for inflation, there is a reason they added $5T to their balance sheet: government spending has added $7T to our national debt since the start of the pandemic. Mr. Trump was obviously part of that, but spending early when we shut down the economy was a lot more necessary than when we were opening up and no longer in recession. Last week’s CPI report of 7.9% annualized inflation was another body blow, with wide-spread inflation throughout the categories. Yes energy was high (but it has been rising for over a year, well before Ukraine), but food, rent, etc continue to punish the American consumer. As the Wall Street Journal noted this week:

The White House was locked and loaded for the bad news on Thursday and blamed, no surprise, Mr. Putin. “Today’s inflation report is a reminder that Americans’ budgets are being stretched by price increases and families are starting to feel the impacts of Putin’s price hike,” President Biden said in a statement. “Putin’s price hike” quickly became a Democratic and media meme. It won’t wash. Russia’s invasion has certainly contributed to rising oil and gasoline prices in recent weeks and, as villains go, he’s top of our list. But inflation had already hit 7.5% on an annual basis in January before Russia invaded Ukraine. The prices of oil and other commodities have been on an inflation-inspired tear for months. Gasoline prices were up 6.6% in February, but they’re up 38% over 12 months. Mr. Biden can blame Mr. Putin for many things, but not U.S. inflation. The root cause is homegrown: Two years of historically easy monetary policy, and explosive federal spending that fed economic demand even though the economy had long ago emerged from the pandemic recession.

The shrill claims of the Biden Administration that there would be no inflation, then that inflation was transitory, and then that it would be normalizing shortly are all etched in the public mind. And no matter what Mr. Biden says at this point, his fingerprints are all over this gasoline price hike, and a day of reckoning is coming to a November near you.

EDIT Update in Response to comment below from anonymous.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach