After months of denying that inflation was a problem (just transitory you see), Joe Biden appears to be finally getting the memo (maybe he’s even reading BATG!?). It was amazing on Sunday seeing some of the Democratic talking head analysts act as if Mr. Biden could just pivot on his message and he could get this back under control. Unfortunately for Mr. Biden, you can’t talk away the mess that you’ve helped create. The administration surely realizes the issue of inflation puts their whole social infrastructure play at risk, as it surely ought to further embolden Mr. Manchin, and the numerous moderates who realize they’re being asked to stay on the Inflation Titanic to get Mr. Biden into a lifeboat.

President Biden: “Did you ever think you’d be paying this much for a gallon of gas? In some parts of California they’re paying $4.50 a gallon. That’s why it’s so important we do everything in our power to stabilize the supply chain.” pic.twitter.com/mhI1QgEmfg

— The Hill (@thehill) November 10, 2021

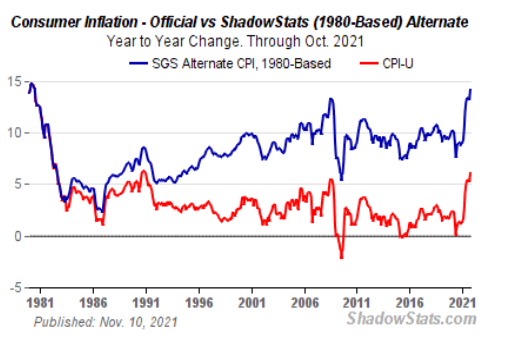

Consumer Price Index (CPI) for October inflated at 6.2% year over year, with October’s producer price index (PPI) rising at 8.6% annualized. John Williams at Shadowstats.com regularly calculates the CPI rate based on the 1980s methodologies, and he shows we’re getting close to 15% based on that methodology. I’m not necessarily endorsing that earlier methodology (I think any index is necessarily suspect and subject to tradeoffs that may or may not be appropriate), but simply to note that the inflation we’re seeing today is causing comparable pain to what was felt in the late 1970s and early 1980s. Politicians took a toll from the public’s angst then, and I suspect the Democrats are going to feel the brunt this go round as they did in 1980.

But back to our series. Now that we’ve reviewed how Aggregate Demand (AD) and Aggregate Supply (AS) work in part 1, and examined the relationship of the quantity of money and its velocity (MV=PY) in part 2, and looked at how any commodity becomes money in part 3, it’s time to think about how it all fits together.

In the long term, I’m quite convinced of higher inflation–significantly higher inflation, because that’s what debtor nations do. Ken Rogoff and Carmine Rinehart’s This Time is Different: Eight Centuries of Financial Folly chronicles sovereign debtors for almost a millennia, and they always do one of two things after they amass too much debt. If they owe the debt in someone else’s currency, they default. If they owe it in their own currency, they debauch–they print it away. Our problem is to understand when this long run will arrive. It doesn’t seem to me to be today, but who knows when we, along with Henry Hazlitt, will be saying, “Today is already the tomorrow which the bad economist yesterday urged us to ignore.” In some ways, we are constantly living in the long run, as today’s realities are necessarily the results of what has happened before. Yet there are often marked changes in economic trajectories, and it’s quite difficult to pinpoint the tipping point. I believe it prudent to act as if the tipping point could come at any time, because it could. Obviously a different issue, but its the same logic/prudence of our call to be ready for Jesus return–it could be at any time. The consequences of not being ready are eternal with the latter issue, but are significant in the temporal with the former issue.

So let’s think of what’s likely next. We began with a discussion of AD and AS, with inflation always being the result of AD outpacing AS. It is clear that in the next year or two that AD will continue to outpace AS. On the AD side, Mr. Biden just signed a $1.2T infrastructure bill, that comes on top of his $1.9T Covid “relief” bill (which of course is on top of the $4.1T that Mr. Trump unleashed, so we’re already @ $7.2T and the Democrats are wanting $1.75T more, with Mr. Biden telling progressives they’ll get more of their $6T drink after that. Let’s be clear: $7+ trillion dollars is a lot of money. And it is going to a lot of core constituencies–the sense of urgency for progressives is that this is their one shot at transformation of the economy, whereas for the special interests, it is their best shot to loot the treasury in the biggest bank heist of all time. This is coupled with the AS side, which is under continuing covid-pressures: workers unwilling to work (for a variety of reasons), some links of the supply chain broken, or repeatedly unlinked as covid hot spots emerge, and the most important marginal change, the Biden administration’s hostility toward business. The latter is arguably the biggest change from Biden to Trump. With Mr. Trump, America was open for business. With Mr. Biden, America is going to shut down a lot of business, to “build back better” with the kind of businesses that progressives like. For example, Mr. Obama famously said he’d like to shut down the coal industry, but under the Biden administration the entire fossil fuel industry is being targeted. And we’re surprised that there has been a decline in investment, and then we’re shocked when every form of energy costs are going up, and when food costs are going up (guess what is a primary input to many fertilizers). This is not limited to Keystone Pipeline (killed by Mr. Biden); there are ongoing regulatory attacks on many producers of energy. The irony is that energy independent America is now forced to beg OPEC and Russia to open up the spigots for fossil fuels, all the while the attacks continue on any new production in the U.S. We often talked about regime uncertainty during the Obama years–the idea that when markets don’t know what is going to come down to punish their investments, they pull back their horns a bit. We’re getting this already in the energy sector, but I suspect it will be much broader than that. When the Biden administration has an arguable communist sympathizer that they want to make a chief banking regulator, one who thinks banks shouldn’t be able to provide checking accounts at all, then the inmates are trying to run the asylum.

An even easier way to think about AD/AS is this: whenever the public sector gets bigger, it takes resource inputs (labor, capital, etc) from the private sector. So the private sector necessarily is smaller, and it is primarily from the private sector that we get those consumption goods that are rising so high. Expect AD to outpace AS.

Big Government = Small Private Sector

Small Private Sector = Fewer consumption goods

Fewer consumption goods = Higher prices

Next up is the monetary part of the equation. We’ve noted multiple times the monetary insanity of the Federal Reserve. The coup de grâce was with last year’s policy reversal by the Fed to openly embrace higher inflation. It was bad enough that for the previous decade they’d argued that 2% inflation was somehow good, but, in this environment, they argued that we need to target an average level of inflation, such that with the previous inflation running a bit lower, they could allow inflation to trend above 2% for extended periods. Yet Milton Friedman will have his day, and the Fed has unleashed a maelstrom. Many economists had become complacent with inflation, since after the financial crisis we’d had massive QE and yet that did not translate into higher inflation. Yet the massive QE was effectively sterilized in that era by both the export of inflation to the rest of the world, and inflation manifesting itself more in asset prices and not in consumer goods prices. When the Federal Reserve started paying interest on reserves, it could more tightly control how much of its balance sheet it allowed to flow into the real economy as opposed to how much it would goose asset prices. But in the covid era, the Fed is allowing its massive expansion of its balance sheet to go into the real economy:

The Fed allowed the money to get into the system because it was trying to balance MV=PY, and with the economy shut down, velocity fell precipitously, and without their action, some prices would have collapsed (guess what, they did anyway–remember airline ticket prices?). But they were attempting to stabilize MV. There is a case to be made for that, but that case would have ended many months ago once the economy started being allowed to function again. Yet they have continued to pour gasoline on the fire, and have said that beginning next month they’ll pour less gasoline on the fire (instead of the $120B/month of asset purchases they propose to reduce that total monthly by $15B). Suffice it to say, the Fed’s performance of the last decade is one of continual policy accommodation to keep stock markets high. Will they develop backbone now that they have unleashed the tiger? Or will they grab the tiger by the tail? I can’t see the Fed stiffening its spine anytime soon. Further, with the national debt rapidly approaching $30T, I don’t think the Fed will be able to raise rates, not without another Ronald Reagan giving them political cover. So in the monetary realm, I see more stimulus coming. Remember, it took the Fed over a decade to come to grips with what it had wrought the last time; we’re early in this game and in much more difficult circumstances with the high national debt and bubble stock prices (both results enabled by the Fed). I see the Federal Reserve and monetary policy continuing to accommodate the inflation that is emerging.

In the final post in this series, I’m going to examine the morality of the inflationary process and offer some suggestions about how we live in light of it.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach