Fellow Berean Matt Beal touched on the 2nd Qtr GDP Growth (negative) last week, and I thought I’d add to the discussion. But because I’m particularly lazy (and the ramp up to the new semester is consuming me), I encourage you to listen to a radio interview I had with Columbus Ohio’s WTVN radio late last week, where I had plenty of time to discuss the issue. This is a bit long (total about 15 minutes) so the recording is broken down into two clips; here is part one and here is part two.

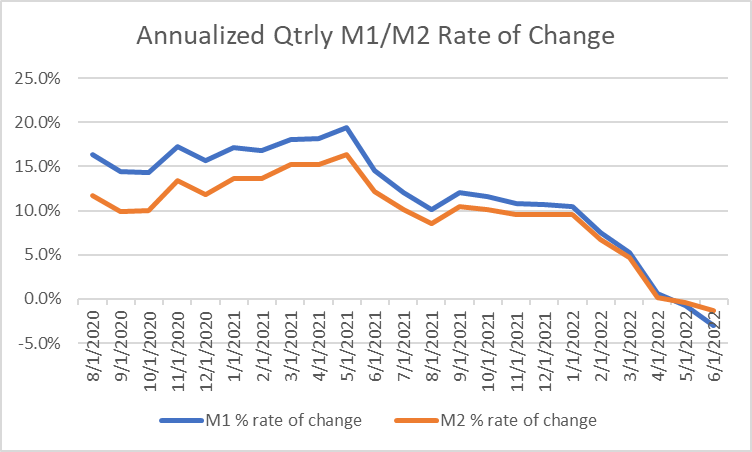

During the interview I was able to mention a big reason the economy is now lagging is that the Federal Reserve has slammed the brakes on money supply growth, and the money supply is shrinking . Nobel laureate Milton Friedman was correct in highlighting that, for monetary policy, while interest rates are not unimportant, the real driver is the money supply. Below I’ve created a chart which shows the quarterly rate of money supply growth for M1 and M2 (annualized) for each month since the pandemic really got moving* While the Fed decreased the rate of money supply growth beginning last summer, it was akin to decelerating on the highway from 150mph to 100 mph–still going really fast. But after the first of the year the car is moving through the school zone at 25mph, and now they’ve put the car in reverse. Milton Friedman famously said it’s not just the amount of the money supply growth (or decline) but the rate of change–so we shouldn’t be surprised at a slowing economy. His other big point on monetary data was that monetary policy takes 6-18 months to have its real effects as it trickles through the economy. I don’t think the Fed is going to change gears in the short term, so I see this negative trend continuing, with a somewhat parallel decrease in the economy. What the Fed giveth, the Fed taketh away.

Long time Berean readers know that my preferred Fed policy position is just stop. As Ludwig Von Mises famously said (joining John Maynard Keynes is saying that Churchill should not engineer a deflation to counteract the inflation they created during WW1), it doesn’t help the patient if, after driving over them with a car, you put the car in reverse, and back over them again!

* The Fed has changed the definition of M1 at the beginning of the pandemic so the distinction (between broad money {M2} and narrow money {M1}) is not so helpful anymore.

Edit Update: In memory of Milton Friedman, celebrate his 110th birthday with Mark Perry on Carpe Diem.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach