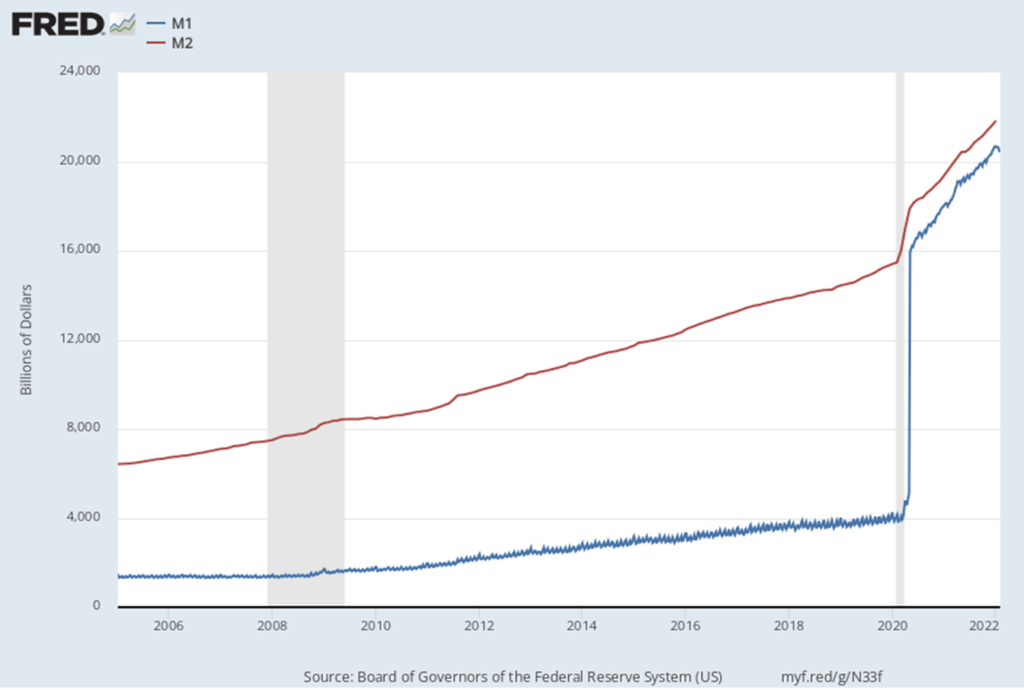

Here at BATG, we took a long look at inflation in a series of posts back in the fall, and it’s still front and center in the public discussion. Yes, I blamed the Fed, but I’ve always blamed the Fed–price fixing never works, and the Fed is the ultimate price fixer. Yet there is now a fairly wide consensus in the economic world that–at least–the Fed has not played their cards well on managing the economy through monetary policy. Some go further, joining me, saying the Fed and stimulative policy has created this inflation dragon. I think the cause of the inflation is pretty obvious, and it’s a chart that I showed my macroeconomics class on Tuesday:

The spike in money supply growth in the pandemic, and the decision to buy $120B in Treasuries and Mortgage Backed Securities (MBS) every month for almost two years is the enabling causal force. The Fed was responding to the fiscal pressures of unprecedented spending–somebody had to buy those bonds and every central bank at the end of the day is the buyer of last resort for their sovereign.

But what’s really interesting is the groundswell of disparate views that are coming to the same conclusion that I have, from an entirely different economic framework. Larry Summers, Treasury Secretary under President Clinton and Chairman of the Council of Economic Advisors, has been blistering the Biden Administration for months on inflation, refuting their claims that spending somehow leads to lower inflation. But last week he turned his guns on the Federal Reserve, for their “wishful and delusional thinking.” Click through the link to read it all, but here is a lengthy portion that nails it (HT National Review):

Start with the labor market. It is now tighter than at any point in history: The vacancy-to-unemployment ratio is in unprecedented territory, quits are at near-record levels and wage growth is still rising at 6 percent, having accelerated rapidly in the past few months. The FOMC expects further tightening, to a 3.5 percent unemployment rate, which it expects will be maintained through 2024.

Three years at 3.5 percent unemployment, something the country has not seen in about 60 years, is highly implausible. Indeed, the historical experience is that when unemployment is below 4 percent, there is a 70 percent chance of joblessness rising rapidly in the next two years as the economy goes into recession.

But that is not the central absurdity in the Fed forecast. The chief problem is the idea that a super-tight labor market will somehow coincide with rapidly slowing inflation. Even on the Fed’s optimistic accounting, a balanced economy requires 4 percent unemployment, meaning that it expects the labor market will remain abnormally tight over the next few years.

Data on vacancies and tightness reinforce the case that such conditions are inflationary, not disinflationary. Wages represent by far the largest component of costs. When they are rising so fast, what basis is there for supposing that inflation will slow to the 2 percent range foreseen by the Fed?

Focusing on the tightness of labor markets as a basis for forecasting inflation is firmly within progressive Keynesian tradition. Many economists look, as Milton Friedman and Paul Volcker did, to measures of money supply or projected government debt for guidance on inflation. These indicators are much more alarming.

Mr. Summers is that committed Keynesian mainstream economist that believes in a very active role for the government to manage the economy. And yet even he is increasingly panicking at what he is seeing in our government institutions. Even non-Austrians can still believe the Federal Reserve and government policy generally can really mess up the economy.

Over on the market side, we see Mohamed El-Erian (the former manager of PIMCO, once the world’s largest bond manager), is emphatic that the Fed has zero credibility on inflation:

The Fed is increasingly being forced to consider what is the least bad policy mistake it wishes to be remembered for: meeting its inflation target by causing a recession, or allowing high and potentially destabilizing inflation to persist well into 2023.

This is a lengthy video clip, but is very compelling and worth your watch. And once again, this is a very mainstream guy–not some wild-eyed Austrian economist that would like to end the Fed. The interviewer continues to press him on how we might be able to have a soft landing, and like me, he really has trouble seeing any positive outcome. The best option would not be in the current situation with the mess they’ve made. It’s precisely why central banks cannot do what they’ve done–feed the inflation monster, and then let it out of the cage. His take? Global stagflation dead ahead.

“They’ve lost credibility when it comes to inflation fighting, they’ve lost credibility in terms of their ability to forecast inflation, and they’ve lost control of the policy narrative.”

Finally, over at the WSJ, Greg Ip argues that the Fed’s claim that it is is possible to engineer a “soft landing” is very tenuous historically. Compared to the few instances Mr. Powell points to, inflation is much higher now, the labor market is much tighter now, and real interest rates are much more negative than previously. Yes, we have a tiger by the tail–and even non-Austrians are setting their sights on the Fed as the source of this problem. And the BATG economic forecast is for more antagonism to the Fed in the days to come.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach