Contrary to the motivational speakers, if you want something bad enough, you’ll do bad things to get it, and get bad results. The Democratic Party is preparing to walk over the cliff with their tax and spend bill, and they will have no escape from the inflationary effects to follow. It won’t matter that this particular $2T is only part of the inflationary tree, or that the monetary root predates Joe Biden. It only matters that when prices are already rising rapidly, and main street is feeling the effect, that the Democrats used their raw, narrow political power to unleash additional spending just at the time the economy was suffering the effects of too much demand and constricted supply. They better prepare to reap the whirlwind.

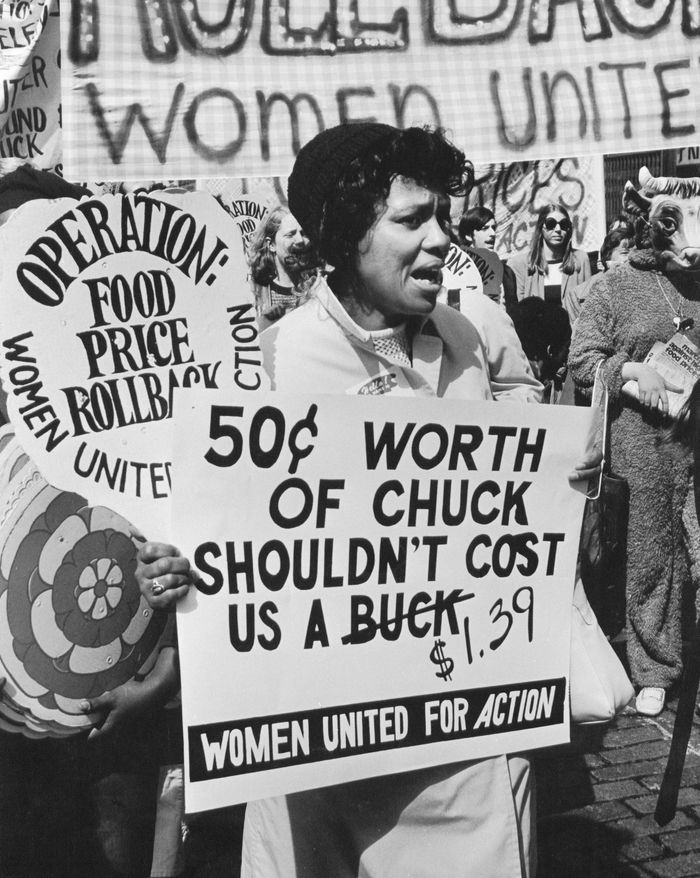

I’ve written previously that inflation is one of those most salient of things that overcomes the “rational ignorance” that most voters have about political issues. When they go into the grocery store and their paycheck doesn’t cover the groceries, they will be most singularly focused on someone to blame and Democrats have all the political power right now. And since most people have the sneaking suspicion that Federal government spending can be inflationary (especially with the Republican’s disciplined focus to tie inflation around the Biden spending spree), I think one party will get the blame.

The inflation issue is getting increasing public attention. Larry Summers (former Democratic Treasury Secretary) continues to opine the Fed and Janet Yellen are wrong and this inflation isn’t transitory. Just a few days ago, CNBC reported that:

Billionaire hedge fund manager Paul Tudor Jones believes inflation is here to stay, posing a major threat to the U.S. markets and economy. “I think to me the No. 1 issue facing Main Street investors is inflation, and it’s pretty clear to me that inflation is not transitory,” Jones said Wednesday on CNBC’s “Squawk Box.” “It’s probably the single biggest threat to certainly financial markets and I think to society just in general.”

Today, in a fit of rhetorical hyperbole, Jack Dorsey, CEO of Twitter and Square, said that the U.S. is heading to hyperinflation. I can tell you I’ve had more interviews with local reporters over the last two weeks on inflation than I’ve had on almost anything since I’ve been in my current job. This issue of inflation is sticky, and it has salience. And when the Fed is now admitting that transitory will be at least until the middle of next year, you really don’t want to be the political party having grand delusions that your trillions of new spending on top of the trillions of previous spending is somehow going to have zero cost. Maybe in the Biden fantasy world, but not in the grocery stores of millions of Americans. Democrats, start your engines, the race to drive over the inflationary cliff is coming to a reconciliation bill near you.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach