In the Sermon on the Mount, Jesus warns us against our hypocrisy, given the seemingly universal nature of our ability to point out the flaws/sins of others while studiously ignoring our own:

7 “Judge not, that you be not judged. 2 For with the judgment you pronounce you will be judged, and with the measure you use it will be measured to you. 3 Why do you see the speck that is in your brother’s eye, but do not notice the log that is in your own eye? 4 Or how can you say to your brother, ‘Let me take the speck out of your eye,’ when there is the log in your own eye? 5 You hypocrite, first take the log out of your own eye, and then you will see clearly to take the speck out of your brother’s eye.

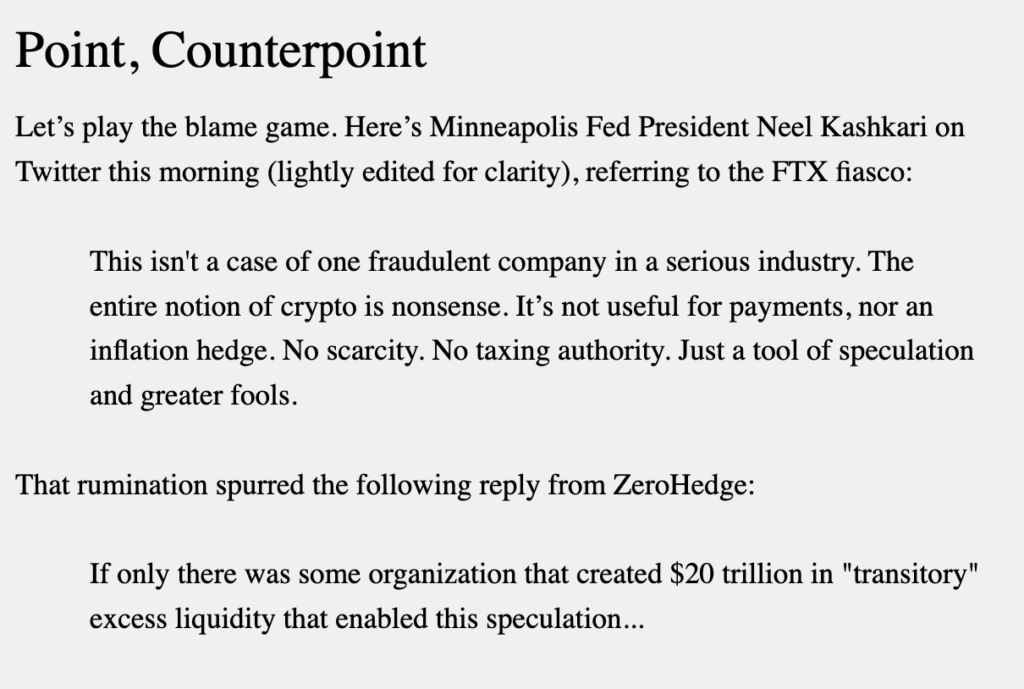

Finding hypocrisy in our public debates is as easy as shooting fish in a barrel, like when President Biden attacks “ultra Maga Republicans” while his party funded many of them in the Republican primary. But some low levels of self awareness really take the cake. From Friday’s Almost Daily Grant’s (highly recommended complimentary email from Grant’s Interest Rate Observer):

I’ve long been a proponent of crypto in the sense of having something outside the purview of government control. I don’t think it will ever be money, because the government will never tolerate any alternative to its own significant power in the course of the provision of money. Further, I would never invest in crypto itself, especially since I don’t trust myself not to lose a digital wallet or have my pocket picked. But I am optimistic about the long-term positive developments in the block chain, and think like most new technologies, the impact will be over-hyped in the short run, while having much larger impact than imagined in the long run. Nevertheless, I am sympathetic to Mr. Kashkari’s last line–it’s been largely a tool for speculation and greater fools in the last few years.

But ZeroHedge makes one of the most in-your-face* counter arguments ever–so powerful because it obviously is so true. After a senior Fed official offers one of the most sanctimonious, judgmental statements about the irrationality of crypto, someone reminds him of the log in his own eye–the fact that the Fed fueled not only the crypto mania, but the stock mania, the housing mania, and, in concert with the global central banks, unleashed the painful inflation we are now seeing. The full effects of which we won’t understand for quite some while. Talk about the pot calling the kettle black.

Well done, ZeroHedge, Well done!

** Yes I’m still calling the Hogs and this jam absolutely rocked the world last week

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach