Today’s afternoon headlines include, “Popular 30-year mortgage rate races toward 8% after hitting a high not seen since late 2000“, “Something is breaking in financial markets” “Dow Falls 431 Points as Bond Yields Climb“. We had a pretty nasty end of September, and October is starting us to the downside. The Dow has now given up all of its 2023 gains, and is now negative, although the Nasdaq, led by the AI bubble, is still up 24% for the year and the S&P500 by 10%, primarily by by five stocks (Apple, Microsoft, Nvidia, Alphabet (Google) and Amazon). But air continues to bleed out of the bubble. China’s real estate implosion continues, and their attempts to stimulate their economy with lower interest rates are causing the Renminbi to come under pressure in foreign exchange markets. The after effects of the global central banks’ inflation are still unwinding, and it may well get worse before it gets better.

As we begin November, markets are starting to actually believe Jerome Powell, the Chairman of the Federal Reserve, who for months has warned markets that interest rates were going to be higher than they expected, and for longer. The surprise was at how steeply the yield curve became inverted (with short term yields quite a bit higher than long term yields), which is highly correlated with recessions in the past. Yet we haven’t fallen into recession yet, with the jobs report today actually higher than expectation (JOLTS report here), causing long term interest rates to spike even higher, as the oft-hoped for monetary ease now seems daily to be further in the future. Of course, the Democrats want you to believe the economy is amazing and pretty soon now (like any day!) you’ll be able to see it too. The Republicans want to tell you the world is just going to get worse until you get rid of Joe Biden. But what do the current data and sound economic theory suggest?

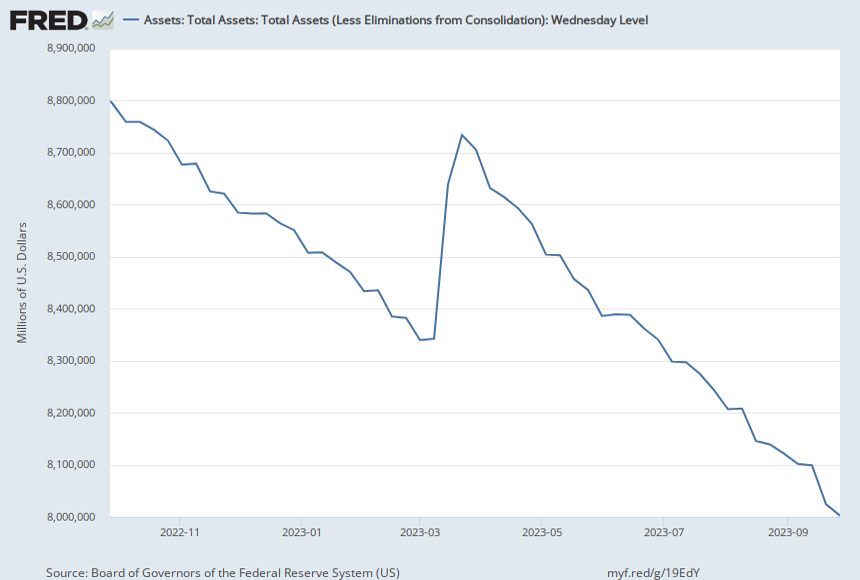

Long time Bereans know that I place a lot of weight on the Federal Reserve, especially their role in financial markets. They enabled the $8T increase in the national debt from both the Trump and Biden Administrations since Covid began, with their expansion of their balance sheet from ~$4T to ~$9T. Dropping $5T in the economy enabled the stock markets to explode during the whole covid period, when meme stocks became the casino of choice. The Fed’s monetary malpractice was most evident by continuing to print ~$85B per month* until Mar of 2022, long after inflation was recognized as no longer “transient.” Nevertheless, since that point, the Federal reserve has been fairly good, both in raising rates to a positive real rate, and in reducing their balance sheet. As seen below, they’ve taken ~$1T out of the economy. We’ve been surprised that it hasn’t had as big an effect as thought, but this is in part due to the bailout we saw this spring with Silicon Valley Bank. As seen in the chart below, the Fed pumped about $350B into the economy in a few weeks (plus calming markets with the implicit Fed put back in play), and this was complemented by massive intervention by the Federal Home Loan Board providing billions more in bank liquidity. Markets naturally responded quite favorably to this monetary stimulus. But in the aftermath of the spring bank crisis, the Fed has resumed its tightening policy, and now the monetary effects on the market are increasing, with the massive increase in long term treasury yields.

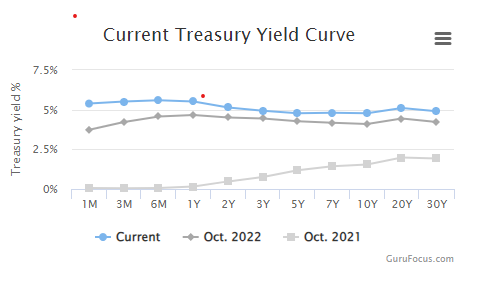

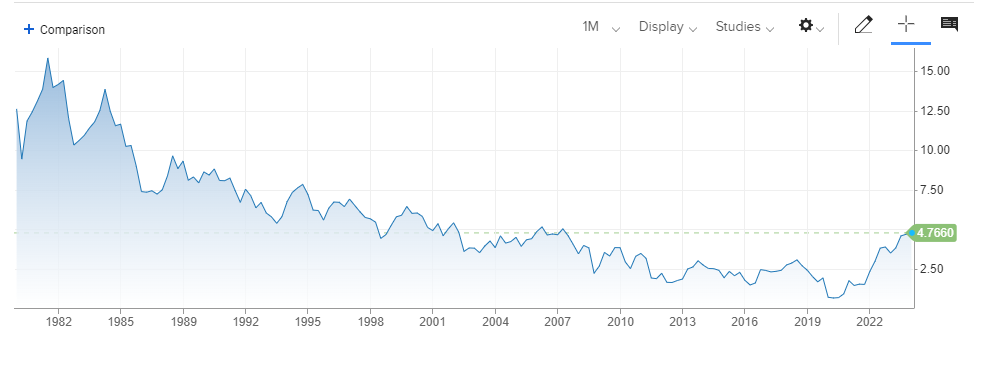

This tightening has resulted in a significantly higher yield curve, with today’s long bond yields getting close to 5%. As the chart below shows, we haven’t seen this level of long bond yield since 2007.

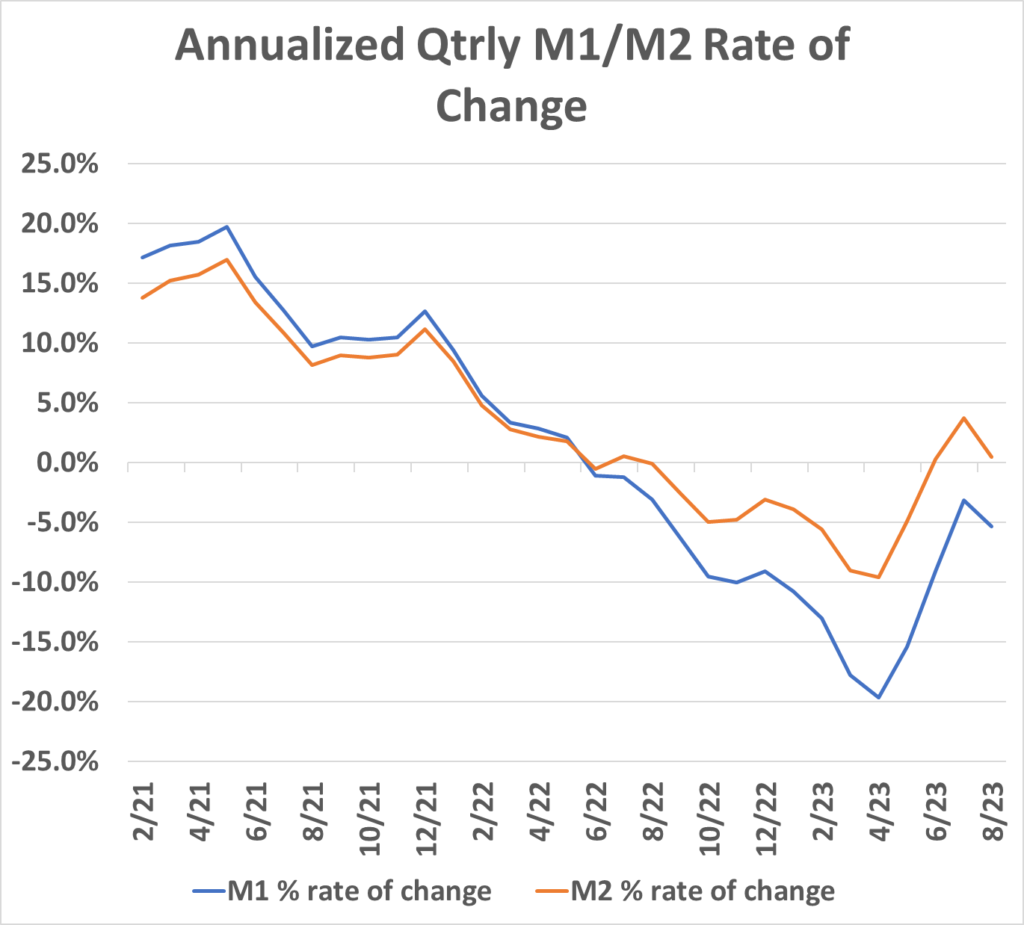

At the end of the day, inflation is always and everywhere a monetary phenomenon, and the supercharged monetary ease has reversed. The sharp monetary collapse was arrested by the response to SVB failure; but in the aftermath of that, we’ve resumed a downward trend. When money supply growth is negative with a moderately growing economy, you cannot get inflation. True, CPI continues to rise–but that is more a reflection of the previous inflation than a measure of what’s going on now. Even higher gas prices now are not inflation, but are actually a relative price adjustment in the face of supply cuts by the Saudis and the Russians, coupled with our refusal to expand domestic energy production. Without more money printing, the higher gas prices mean other prices will fall, as budget limited consumers will be forced to curtail other consumption. As seen with the latest release of monetary data, money supply growth has resumed it’s negative trend (with the spike upward reflecting the SVB monetary injection), so the support to financial markets we saw in the late spring and summer is now gone.

So what is the future direction? I think the consensus is pretty much on target, maybe one more rate hike and done. But I think a much more important question is will the Fed continue its balance sheet reduction. What I would like them to do is to stop the interest rate increases, as I don’t want to see a financial crisis emerge that forces them to significantly cut interest rates in the future. We don’t want high interest rates, we don’t want low interest rates–we want normal interest rates. And on the Fed’s balance sheet itself, I would be in favor of stopping the balance sheet active reduction, and allow the existing portfolio to run off (i.e., when a bond matures, don’t replace it). This would allow the balance sheet to shrink, but much more slowly over time. Right now the global economy is slowing, the American consumer is looking pretty tapped, and financial market stress is rising. And over the next year we’re going to see much more financial pain as previous debt expansions will have to be rolled over at much higher rates (i.e., commercial real estate) which is going to cause much more pain. The odds are still high that the economy will be weaker next year than this year. Most observers assumed the Fed would not want to be seen as restrictive in an election year, and would therefore be lowering rates early next year. I think that hope is increasingly off the table.

* The Fed did lower the rate of increase in the months preceding Mar, but they were still printing the week before they began tightening!

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach