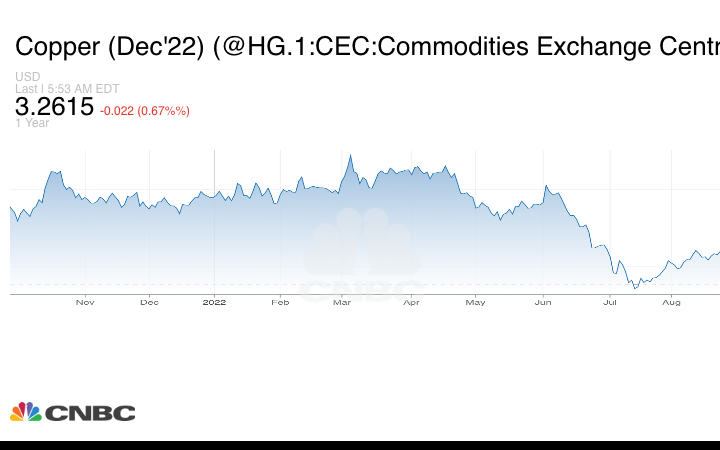

We haven’t had an update on the economy in a bit, so this post will share some of the data I’m finding interesting, which I believe is telling us where the market is going. Last week the price of the ten year US Treasury Bond fell, leading to a yield of over 4%, a level not seen since 2010. The global economy continues to slow, and commodities prices are falling. Lumber prices are now back down to their pre-pandemic level of ~$450, and oil is around $80 after hitting north of $120/barrel last year. Dr.* Copper is down~33% from its price earlier this year:

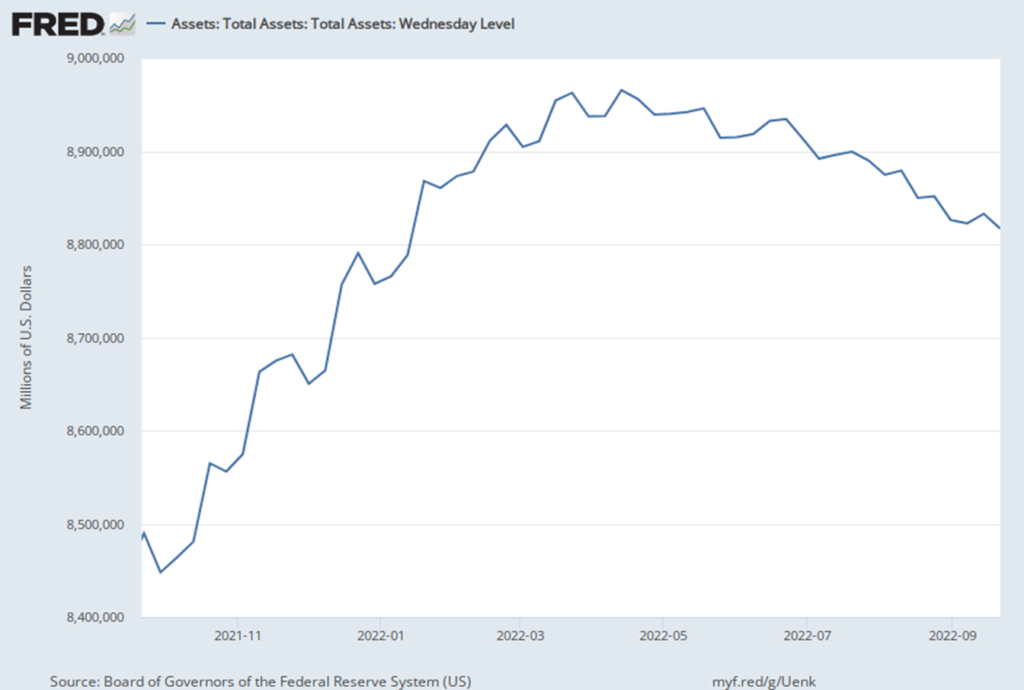

So where are we going? I am a broken record, with my grand narrative still focused on what the Federal Reserve is doing. Last year I suggested this is a pretty easy call for a bear market, and the only reason I didn’t short the market is that I didn’t trust the Fed would have the courage to follow through–well, suffice it to say that so far the Fed is holding firm. Below is a chart of the decrease in their total assets (recall they bought ~$5T of assets in the two years ending following the pandemic). Quantitative tightening is now here, with the Fed allowing bonds in their portfolio to “roll off,” meaning as they mature they are not replaced. Tightening has now entered a new phase; beginning this month the Fed will allow $60B of Treasuries and $35B of mortgage backed securities to roll off–a pace that will take a trillion dollars off their balance sheet in a year, should they not back off.

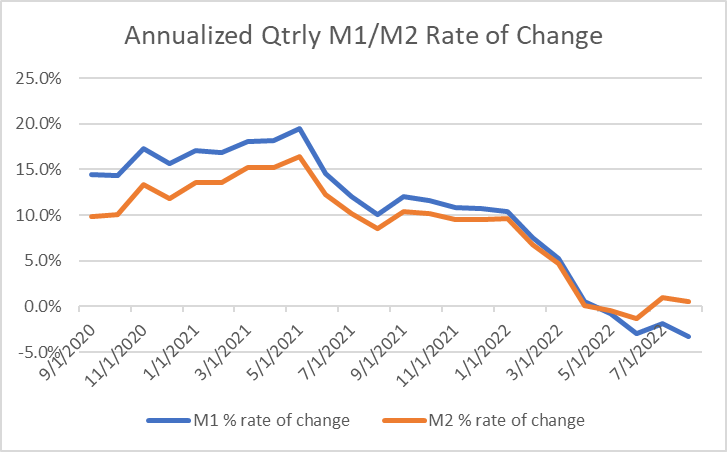

This combination of lower balance sheet and higher interest rates continues to throttle money supply growth. Last Tuesday the Fed released numbers for August, which I’ve plotted below, and the slightest of increases we saw in July have reversed back to a negative trend. It’s hard to see the economy picking up any steam with negative money supply growth. My expectation is that GDP growth will do no better than stagnating over the next six months, but is more likely to decrease further, especially when you consider other headwinds.

These other headwinds are most importantly China. China’s real estate bubble burst last fall, after Xi Jinping said that “houses were for living in, not for speculation.”** China’s economic leaders are trying to put humpty-dumpty back together, but the daily press reports I follow suggest it’s not going well. One report (source forgotten) from earlier last week suggested China’s housing market has improved from “terrible” to “really bad.” This is exacerbated by the zero-covid policy which has greatly reduced economic activity in China. Make no mistake, the drop in global commodities, to include oil***, is largely due to the implosion in China and the declining global economy.

Finally this takes us to the markets themselves. We’re now back solidly in the bear market, with the summer rally hopes of the Fed quickly reverting to monetary ease has evaporated, and the realization that this inflation fight is going to be longer than people hope. This operates in multiple dimensions. First is the increase in rates means stock market valuations predicated on easy money have to reprice to the new reality. Second, many firms gorged on cheap debt over the last decade, and will have difficulty servicing their debt at these higher levels as their debt renews. Third, the increase in U.S. interest rates has been dramatic, with other countries in Europe and elsewhere only belatedly starting to increase rates. This massive swing in interest rate differentials is driving global investment to come to the U.S., with the dollar hitting multi-year highs in most currencies. This is hitting most of the large multi-national companies, with large part of their profits earned in foreign currency, resulting in much lower dollar denominated profits for the firm as a whole.

There is obviously much more data we could look at but the general trend to me is clear: Markets are going lower; the bear won’t give up until the Fed does. The global economy is going to have a recession, and we’ll be joining them soon, if we’re not already in one. Inflation will continue at a higher pace (>2%) but we’ve seen the peak and will slowly retreat over the next year (lagging items like rent and some embedding of inflation expectations will keep us higher until we are in the recession). For those panicking over interest rates and wanting to buy a home, my expectation is that the Fed will stop their quantitative tightening and revert to ease once the recession is fully in place–but only after they get to a point they can declare victory over inflation. Last week’s sharp reversal by the Bank of England to buy more bonds is essentially the wildcard we have here, as I expect the Fed to do the same when and if we face a similar market meltdown. I don’t always agree with Ron Insana at CNBC, but I think his fear that the Federal Reserve’s tightening phase will lead to a market meltdown and subsequent reversal by the Fed is a highly likely outcome, just as we witnessed in England last week.

Our hope has never been in a 401k, or in our nation’s leadership, as we need to hold loosely to things of this world. And that is never more apropos than now, and in this market.

** Copper is often referred to as Dr. Copper, since it has a “Ph.D. in economics”–easily one of the best indicators of economic growth, since copper is widely used in construction, and therefore a proxy for economic growth.

** Xi Jinping said this is 2017 at the last communist party congress, but their government policy really ramped up the action to tamp down speculation last fall.

*** Yes on the margin Mr. Biden’s naked political act of selling from the Strategic Petroleum Reserve to help him in the election does reduce oil prices–but its on the margin. The biggest causal force is the rapidly slowing global economy. BTW conservatives, be careful with how you attack Mr. Biden on his selling the SPR. With the impending recession, he’s likely to be able to replace the oil at much lower prices than he sold it at. It’s still a bad political act, replacing the word “strategic” with Democratic Protection Petroleum Reserve, but I suspect we’ll actually make a good bit of money by selling high and buying lower.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach