Alexandria Ocasio-Cortez, known as AOC by her fans, is the dynamic new congresswoman from NYC who openly embraces seemingly every nonsensical thing that formerly was considered a caricature of Democratic thought. And rather than being considered crazy by her party, she is lionized by the younger energetic part of the Democratic base. Sit in at Nancy Pelosi’s office? You go girl! Call capitalism immoral? But of course! Mr. Trump a racist? “No question.” Whatever you think of this firebrand, you can clearly see she speaks her mind! And she doesn’t intend to play by your (or my) rulebook.

In many ways she is the female antithesis of Donald Trump. One of Mr. Trump’s endearing traits to his supporters is his willingness–indeed his fearlessness–of challenging his opponents most cherished ideals. Politically correct he isn’t. But just as Mr. Trump runs headlong into reality with some of his economic mischief (e.g., protectionism), AOC also has many ideas and plans that are not in line with reality. Politically popular among populist youth, yes. But economically sound? Not in the least.

Perhaps the most endearing belief of modern progressives is that income inequality is the root of all evil; Ms. AOC lists this as a reason why capitalism and billionaires are immoral. So her solution? 70% marginal tax rates on those making over $10M/year. After all, her cheerleading Nobel-winning economist Paul Krugman thinks it would work out just fine–we had a pretty good economy back in the ’50s with much higher rates. University of Chicago economist John Cochrane demolishes that argument here, and a couple of the key points are here:

Throwing around high statutory tax rates in the 1950s as if anyone actually paid them is past disingenuous at this point, as often as the opposite has been pointed out……The one thing we should learn from the New York Times and others’ probes in to Trump Tax Land is just how far very wealthy people will go to avoid paying taxes. Especially estate taxes — there is nothing like the government coming for nearly half your wealth to concentrate the mind. I venture that we would have gotten a lot more out of the Trump family with a 20% VAT and no income tax or estate tax!

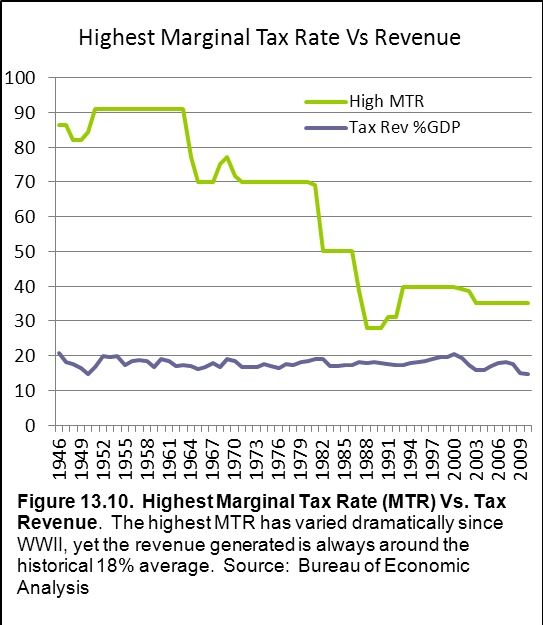

We’ve shown this chart before, but it seems like progressives are unaware* of it:

Progressives seem to think if they just tell people to pay higher taxes, they will. Not only is Mr. Cochrane’s point about Mr. Trump trying to avoid taxes true, so it is with all of us. How many of you readers have bought online before to avoid paying sales taxes? How many of you have considered making large purchases in a nearby state with lower sales taxes? Much of the exodus from California is due to its high tax rates. In the chart above, we can clearly see that in wildly varying high tax rates, the revenue the federal government receives is fairly constant, averaging around 18% of GDP. Yet progressives will continually say, let’s just tax the rich, as if that would have meaningful change in the government revenue coffers.**

But its worse than that, of course. In line w/AOC thinking, Oxfam released its latest report on the dire world circumstances due to income inequality, because the world’s richest 26 people have net worth equal to half the world’s population.

Governments are fueling inequality by underfunding public services whilst “under taxing” corporations and the wealthy and failing to clamp down on tax evasion, the report alleged. While a new billionaire was being created every two days, Oxfam said the tax rates being applied to those individuals had fallen to their lowest in decades.

For some reason, Oxfam doesn’t seem to care that in this terrible last 30 years of amazing income inequality, global income inequality has fallen, and we have removed over 1 billion people from extreme poverty! Free markets, globalization and reasonable tax policy have done that.

The progressive response? I’m hungry, can I have another bite of that golden goose?

*AOC has a degree in international relations and economics from Boston University. Please tell me that she skipped the econ classes.

** Bonus ??s for Berean readers to discuss in the comments. What do you think happens to the demand for political “help” in a high tax rate world? Hint: why do you think higher tax rates in the late 40s and 50s didn’t generate more revenue? What does that suggest would happen should Ms. AOC have her way?

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach