Standard financial analysis suggests the value of any stock is equal to the present discounted value of its future earnings. Thus an increase in the price of any stock is due to either an increase in expected future earnings, or a reduction in expected future interest rates, or some combination thereof.

With today’s close at 3392 and change, the S&P 500 hit its first new record since Feb 19th, and is up 5% for the year. The disconnect between Wall Street and Main Street is sure to stoke resentment from populists: Wall Street is getting rich while the average American is getting crushed by the global pandemic. As the WSJ reports:

The stock market’s turnaround reflects investors’ bets on a pickup next year in corporate earnings and economic activity. But many are struggling to reconcile the gains with the continuing health crisis that has killed more than 170,000 people in the U.S. alone, sent unemployment to the highest level since the Great Depression and spoiled the longest-ever economic expansion. “There’s a feeling of euphoria in the marketplace that you’re going to make money,” said Steven Wagner, chief executive of Omnia Family Wealth, of his interactions with investors in recent weeks. “But they’re also bewildered by the disconnect [with the economy] and what they see in their businesses, their lives and what stock prices are doing.”

Yet there is no puzzle to this divergence between Main Street and Wall Street–they are both caused by the same thing: US government policy. It was the policy of states and the federal government to shut down our economy, and hamstring many parts of it since. Without making a judgment on the wisdom of that decision, there is no doubt at what caused the current economic downturn: We were ordered to shut the economy down. Further, there is no doubt that the ongoing restrictions are significantly hindering recovery.

But how then is the market doing so well? It is not due to expected future earnings, or even lower interest rates in the future (although that’s a distinct possibility). It’s rather due to the Federal Reserve basically guaranteeing the markets with the dramatic expansion of their balance sheet. What was the Fed put (the idea that the Fed would prevent investors from suffering large losses) has now morphed into the Fed guarantee that you won’t lose money. Indeed, they’re enticing you with certain gains to stay in the market.

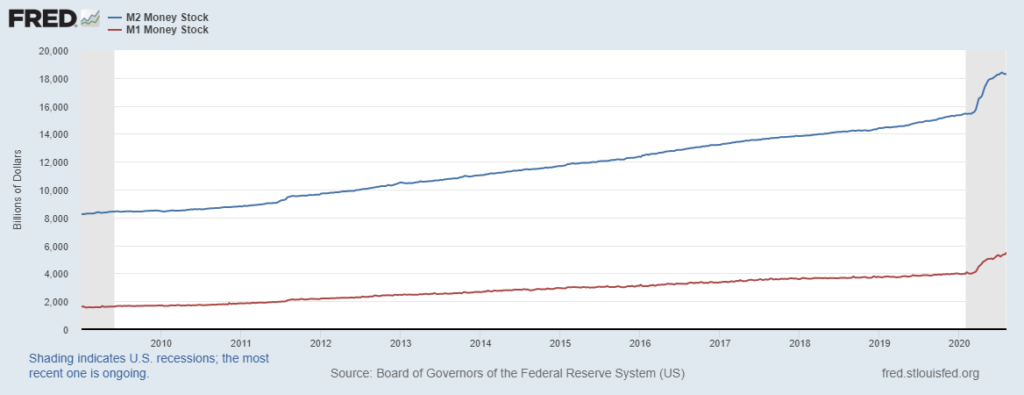

Stay at home Millennials are signing up for Robinhood by the millions since the start of the year, and the crazier the investment, the more likely they are to invest in it (e.g., the curious idea to buy stock in bankrupt Hertz). But of course it is not just Millennials, but the broader market that has to find places to park the fantastic liquidity that the Fed is creating–unprecedented liquidity. The Fed has expanded its balance sheet by ~$3T (almost doubling) since the crisis began, but unlike the QE after the financial crisis, they are not sterilizing it (i.e., preventing it from entering into the money supply).

As the chart above shows, both M1 (narrow money) and M2 (broader money) have risen sharply since the crisis, with M2 up over 23% in the last year. The money the Fed is creating not only has to go somewhere, which of course it does, but it is designed to stabilize markets to keep confidence up. Yet as the stock market and the real economy diverge, this not only will lead to further resentment toward rich people, but will lead to capital misallocation and hinder the future recovery of our economy. When prices are distorted, investment flows into the wrong areas and it will take longer for our economy to recover. Regrettably, as always, Capitalism will be blamed for this evil even though the results are predictably driven by government policy. Markets would not go insane without a government put.

BTW, have you noticed that goldbugs are finally rejoicing? What’s that all about?

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach