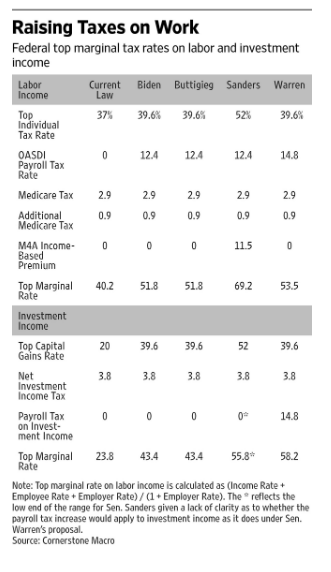

“I have a plan” is the mantra of the maven of Massachusetts, Elizabeth Warren. But thanks to the folks at Cornerstone Macro (HT WSJ) we can see her plan for taxes, as well as the other near competitors.* None of these competitors has provided these numbers in this summary form, but each have proposed or endorsed various plans (e.g., Green New Deal) that require tax increases such as these. So, for example, as seen above, each of these candidates wants to extend social security taxes to all income, which is currently capped.** Whatever the arguments for extending that particular tax, there is an impact to proposing dramatically higher taxes on income. And of course, that is coupled with the Democratic calls for higher taxes on investment income. Increasing the capital gains rate is particularly noxious when the tax is not indexed for inflation so that taxes must be paid on purely inflationary phantom gains.

But more importantly, these taxes on capital slow the rate of growth, as they tend to reinforce or lock in capital to existing areas, as more profitable (and usually higher growing) new opportunities must be even more compelling for an investor when they have to pay taxes to pull capital out of an existing investment to redeploy it. All of this results in a stagnating and slower growing economy. And as I’ve said repeatedly, what we need more than anything else given our fiscal challenges, is a high growth economy. Whenever the day of reckoning occurs, which both parties insist that we head to (albeit at different rates), it will be most helpful to have a much larger private sector economy than we currently have.

Even worse, none of these numbers include what’s going on at the state level. So if an individual lives in high cost and high income Silicon Valley, where the state tax can go as high as 13.3% (with San Francisco adding another 1.5%) and you’re pushing 70% taxes. I suspect most Americans would answer these two questions differently: 1) should the rich have to pay more in income taxes?, and 2) should higher income classes have to pay at least 2/3 of their income in taxes?

Now there are at least two responses that a reader of a different perspective might say. First, might be, but nobody actually pays that high a rate because all of the tax loopholes. I say that’s right–but where do those loopholes come from? And what is going to happen to the number of loopholes with higher tax rates? Higher tax rates are a windfall for the K-street lobbyists and politicians who can extract political contributions to carve out exemptions for their special donor class issues. Expect corruption and political payoffs to increase greatly in a Warren or Sanders Administration. The better solution to higher income people not paying much income tax because of shelters is to lower their income tax rate, and eliminate all the shelters. So if we have a 20% high rate, its a true 20% high rate.

A second response is so what–they’re rich, they don’t need the money, we have compelling social needs so they should pay. But that ignores what the sheep are likely to do–they are not going to just sit there and be shorn, not over the longer term. They will adjust their activities in response. And the response will increase over time as they can figure out different ways to cope with the tax. As we’ve seen increasingly over the last decade with the exodus from high tax states to lower tax FL, TX and NV–people respond to incentives. And the more time they have, the larger the response will be.

Henry Hazlitt remarked that the good economist will “see the unseen”; not just the first order effects, but also the 2nd order. I would add this is also a mark of a good Berean–carefully considering the evidence. You don’t have to have 20/20 vision to see the second order effects of a Warren or Sanders presidency, if they actually implement their proposed policies.

* I am not a subscriber to Cornerstone Macro, so I have no independent ability to look at their calculations. For the sake of this blog, I’m going to assume this is true based on WSJ credibility. But of course, this could be fake news–caveat emptor!

** The rationale for capping SS taxes on higher incomes is that ostensibly SS is not a tax but a forced retirement program. Since high income earners have contributed enough by a certain income level to fund a generous retirement, there is no need for them to be forced to fund themselves a more generous pension. But given all this de jure is a lie de facto, i.e., the Feds treat SS “contributions” as tax revenue to spend willy-nilly, you can see why this is perceived as a “tax break” for the rich.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach