I’m willing to accept for the sake of argument that in the internal battle within the Trump Administration over whether the tariffs are tools to 1) negotiate free trade or are 2) non-negotiable to force manufacturers back to the U.S. that Mr. Trump wants free trade and believes that his tariffs will both get us there and with free trade, U.S. manufacturing will be strengthened since he believes we’ve been “ripped off.” I also agree that the U.S. has more leverage in any trade war because other countries are more dependent on us than we are with them. But I think that the war analogy is appropriate, because in war, both sides lose. Yet there are particular vulnerabilities in the U.S. economy that are manifesting themselves right now.

First, we started this with markets with very high valuations, priced to perfection. In an cyclically adjusted PE (a measure of valuation), the S&P500 was at a level only exceeded by the tech bubble and the insanity of Covid money pumping and close to the level of the great depression.

When assets are priced to perfection, and you start a trade war, lookout below. As I often tell my students in money and financial markets, if stocks fell 50% from their high, they would not be cheap from a historical basis. Now earnings have been good in the past several years and could justify a higher level of PE, but what is going to happen to earnings if we radically restructure the global economy in a trade war? That is exactly the conundrum that markets are trying to process now. Further, when you start from frothy times, there is an incredible amount of leverage (borrowed money) that quickly has to be covered when the underlying assets fall in value, which can lead to big moves down, and have a cascading effect as when one leveraged player has to sell at low prices, that creates margin calls on others, who have to sell….and down we go.

The second major issue is we are doing this at a time when we have $2T/year deficits, and a $36.7T national debt, of which we have to refinance about 1/3 of it every year. So we are bringing almost $15T to the global debt markets for funding each year, and after the inflation we just had, our central bank is not buying our debt (nor should they!!!). Much of this buying comes from foreigners. When we start trade wars, we make the U.S. a less desirable place to invest. Indeed, if Mr. Trump has his way and the trade deficit falls, so will our capital account surplus (which is where foreign buying of our debt could be seen). That means financing our debt is going to get more expensive and interest on the debt already is more than we spend on national defense. DOGE better get going! This negativity has been seen in the bond markets over the last several days (continuing this morning):

You can see the action in the 10 year bond above over the last five days with a massive spike in rates. The 30 year bond rate (not shown) has similarly spiked about 50 basis points to almost 5%.

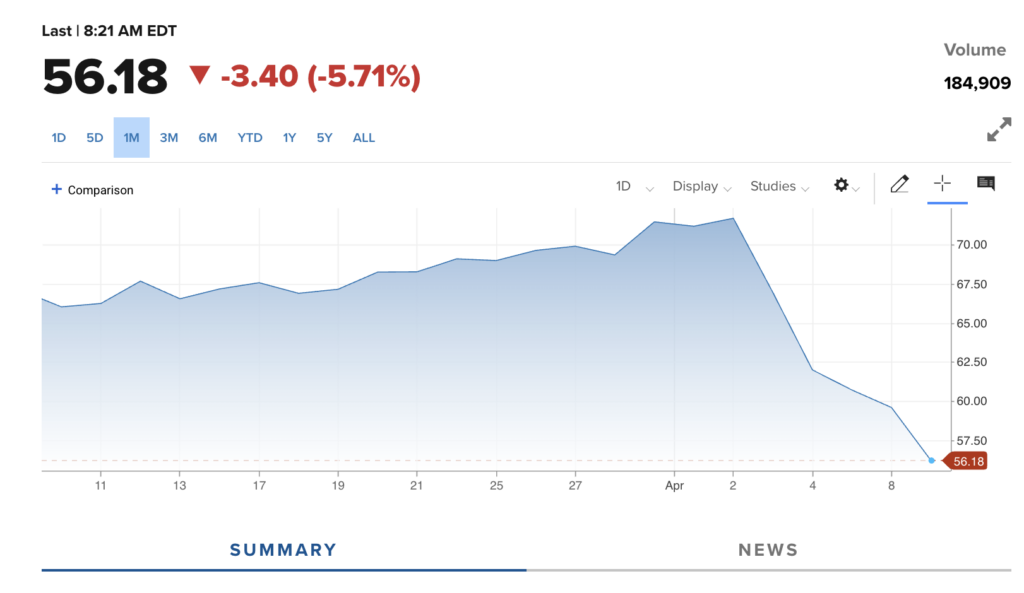

Further we are seeing oil prices drop like a rock. While in normal times that would be great news, this is more a reflection of the market pricing in a massive drop in global demand. And that takes us back up to the elevated stock prices, if we have a global recession caused by Mr. Trump’s trade wars, you can expect your retirement fund to be much lower in the coming months.

Finally we need to see how this will be reflected in the U.S. dollar. A strong dollar helps with inflation as goods we buy from abroad are cheaper. With Mr. Trump scaring foreign investment away, the dollar is falling to six month lows, and especially since the tariffs were announced:

Now it’s true–other countries will lose more than we will. And hopefully they’ll see that and capitulate first. But “events, dear boy, events” means that we can’t be sure where this will go. And on the other side, even if things go the best way possible, the U.S. reputation will be much lower that it was before. Humpty Dumpty may not be able to be put back together. The best scenario would be for the U.S. to announce several deals this week with countries to significantly reduce tariffs on both sides. If Mr. Trump doesn’t become the ultimate dealmaker and soon, he’s going to find himself all alone. And the supine Republicans who won’t speak up for free trade now will be coming for his head. “Whose throat do I get to choke if you’re wrong?”

May God give wisdom to leaders across the globe.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach