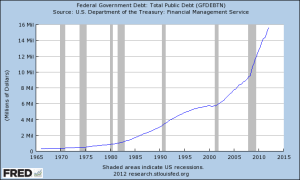

Our national debt is $16.75T, our unfunded liabilities are ~ $120T, and President Obama says we have no debt crisis. In a post last week on the national debt and deficits, I promised we’d discuss the morality of passing the debt burden on to our grand-kids. As is often the case, our moral senses are corrupted by Keynesian economics when thinking about the national debt. After all, in the Keynesian world that almost all Washington DC lives in, savings and thrift are bad, and consumption is good, as outlined here by Professor Paul Krugman. Most of us understand that too much consumption is a bad thing, and its almost hard to save too much. In any case, we can count voluminous friends and acquaintances (and perhaps look in the mirror!) who consume too much and save too little, but we’re hard pressed to find anybody who is too thrifty. So I think we can safely agree that spending too much rather than saving too much is more likely our national problem.

So if this is so obvious, why are there so many Keynesians who think this way? The answer is that they believe we suffer from a fallacy of composition, where what is true of the parts is not true of the whole. While it may make sense for an individual to save, it does not make sense for the whole, because if everybody saved, who would do the consuming? As Krugman says,

“We’re awash in excess savings. And if you decide to save more, it’s not actually going to help society… If there’s one crucial thing to understand about all this it is that the global economy, money moves around in a circle. And my spending is your income, and your spending is my income. And if all of us try to spend less because we want to save more, we don’t succeed. All we end up doing is creating a global depression…

The missing piece to this puzzle–that Keynesians fail to appreciate–is how savings coordinates consumption across time. While its true that massive shifts from consumption to savings would be disruptive if done in an abrupt way, simply reducing consumption in favor of savings would not–as Professor Krugman suggests–cause a depression. Rather the price signal sent by interest rates (if not corrupted by Federal Reserve policy which is all to often true) will steer the savings to produce longer term investment goods instead of consumption goods. The economy does not automatically go into depression because of savings, but it will be transformed with more resources used to produce capital goods (rather than consumption goods). This will allow increased output later, at a time when the people who save today want to consume. So, what’s this got to do with national debt? Not much, other than it shows how Keynesian thinking goes astray when it asserts that what is undeniably true for an individual (i.e., thrift is good) is not true for the nation.

So let’s now consider our national debt. The Keynesian says that the national debt is not a burden to our grand-kids, because we owe it to ourselves. Quoting Professor Krugman again,

People think of debt’s role in the economy as if it were the same as what debt means for an individual: there’s a lot of money you have to pay to someone else. But that’s all wrong; the debt we create is basically money we owe to ourselves, and the burden it imposes does not involve a real transfer of resources.

Perhaps the Nobel Laureate in Economics (for his work on international trade) should have consulted with the Nobel Laureate in Economics James Buchanan (who won the award for his work on public finance and public choice)–or at least be familiar with the literature prior to making statements about the economics of public finance. Buchanan pretty convincingly demonstrated that we do pass the burden of debt onto future taxpayers in his 1958 book, Public Principles of Public Debt. In any case, I’m not aware of any Keynesian refutation of Buchanan’s work, or for that matter even a serious attempt at refutation. Don Boudreaux over at Cafe Hayek has an excellent extended discussion of this for those wanting a more detailed understanding. But for our review, I will simply say there is another Broken Window Fallacy at work here. The basic Keynesian argument is that since for every public debt, there is a public debt bondholder. Aside from any distribution issues (i.e., that the future bond payment recipient may not be the same person as the future taxpayer), so the burden in the future is nonexistent–there will be taxpayers paying the debt off and taxpayers receiving the debt payments. Like Bastiat’s broken window fallacy, we must ask what would have the dollars been spent on if not for either the broken window or the public works. In our national debt discussion, the savings used by the government would have been available for other purposes, perhaps investing in a new business. So in the future the U.S. would have the yield from that investment. The one who invested in it would receive the payments; she would be richer and no one would be the poorer. This is contrasted with the deficit spending where one citizen becoming richer by the debt repayments must be matched by an offsetting debt payment by a taxpayer. This does not mean that we can never deficit spend, nor does it mean necessarily that our grand-kids are worse off. One can hypothesize situations where the current government spending is so productive our grand-kids will be happy that they have the debt to pay off. Perhaps if the NIH spending were able to eliminate every disease and the FDA were to eliminate all E-coli and the EPA were to eliminate all particulates in the air with minimal economic costs on business. But this illustrates the point–Our grand-kids will be paying the bill, and the question becomes what are they getting for their money? Much of our current public spending is arguably current consumption, despite the politicians cry for us to “invest” more in the public sector. Solyndra and green energy failures, stimulus spending for Democratic constituencies like the public sector unions, and the like may lead our grand-kids to conclude we have squandered their inheritance–indeed, leaving them with a negative inheritance–eating their seed-corn.

While Keynesians and President Obama suggest our public debt is not a problem, Proverbs 13:22 tells us “A good man leaves an inheritance to his children’s children”. As James Buchanan has shown, the Keynesian emperor has no clothes–deficit spending passes the debt burden to our children, at questionable benefit. Some might call the debt we’re leaving our children odious…but that will be a post for another day.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach