Regular Berean readers may be wondering–are the Bereans AWOL? Do they not care about the issues anymore? Do they think that there is no need for Christian political economy now that Mr. Biden has rescued us from Mr. Trump? Or maybe they are just academics who think the summer is a sabbatical for….whatever academics get to do in the summer? I can assure you one thing–it is not because suddenly we think the world is made right. But cursing the darkness is not as productive as many of us would like, and the Biden administration is giving us plenty of economic darkness. The spending policies, the tax policies, the regulatory policies–all are heading in the wrong direction. And Mr. Trump’s singular biggest economic mistake? The Biden administration has not ended the trade wars, even on our friends the Canadians, so your new house is costing you $36,000 more because of increased lumber prices.

But I don’t want to address inflation as a whole, even though daily there are more signs of the inflationary effects of the Fed’s policy–food (especially meat), gas–pretty much all commodities. And this is greatly exacerbated by the Democratic stimulus efforts to pay workers not to go back to work (which hopefully will end at the end of the summer, although workers are needed now so why wait?). Help wanted signs are seemingly everywhere, with entry-level wages ~$13.5/hr. We’ll have plenty of time to discuss inflation as it is here, and it is not going away.

What I want to suggest today is that what is happening in monetary policy is not totally unrelated to the ongoing moral collapse we see elsewhere. As the Prophet Isaiah tells us,

Woe to those who call evil good and good evil, who put darkness for light and light for darkness, who put bitter for sweet and sweet for bitter.

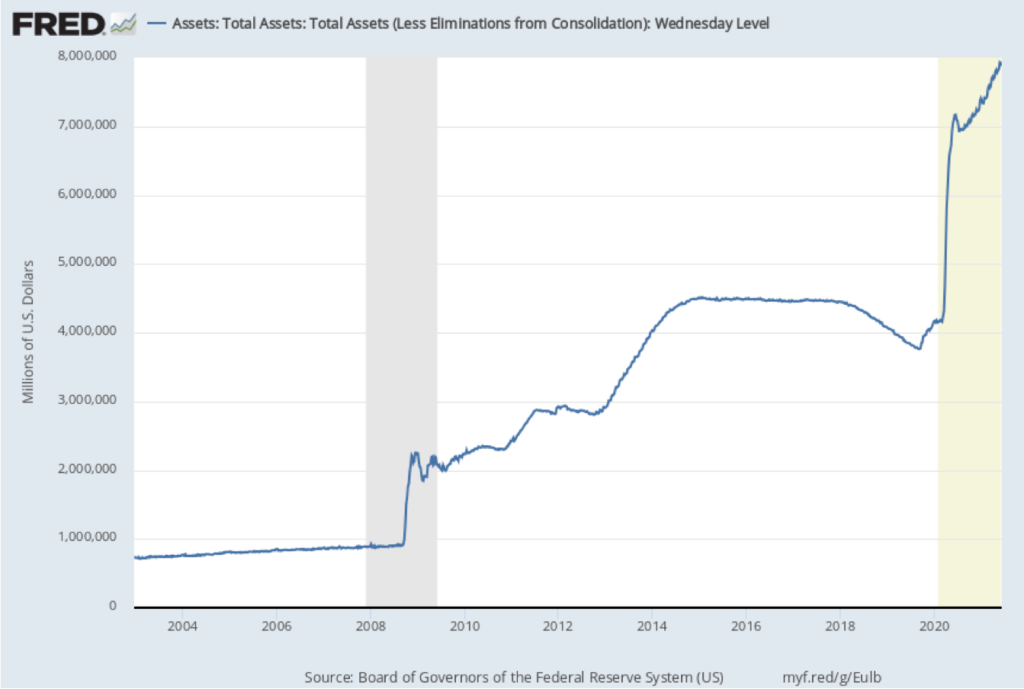

Our culture celebrates sinful behavior, but our sinful behavior does not manifest itself only in sexual rebellion–rather God increasingly gives us over to our own autonomous desires in multiple areas. Sound monetary policy has long recognized inflation as a scourge. It is a hidden tax that is not equally applied, and in its later effects (when consumer prices start rising, which is where we are now) it disproportionately affects the poor, since they spend a larger percentage of their budget on consumption necessities. It’s true that the Keynesian economic view has always judged inflation to be not as harmful as unemployment, and given their view that 1) we are only rarely in the world of full employment equilibrium and 2) there is a tradeoff between inflation and unemployment, you could understand the favoring of inflation. The costs of inflation were seen as real, but low compared to the social harms of unemployment. But we have left this world, with its idea of a 2% inflation target as something to be tolerated to ensure full employment, and the last decade saw a 2% goal of inflation as a good in and of itself. But the Fed has now embarked into the brave new world of inflation that would be allowed to go higher for extended periods of time, to make up for it’s underperforming in previous years. You see, what was once considered (at best) a necessary evil is now considered a good thing in and of itself. The Fed is buying ~$120B in Treasuries and Mortgage Backed Securities with seemingly no concern for the economic distortions they are leaving in their wake. Do you think there is no connection to government profligacy and the Fed standing ready to buy their debt monthly? That there is no connection to skyrocketing housing prices and the Fed’s purchases of $40B in MBS per month? In earlier times we understood that excessive money growth unleashed speculative manias–and yet we have financial mania after mania, with asset prices disconnected from future cash flows. We are sowing the wind, will we now reap the whirlwind?

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach