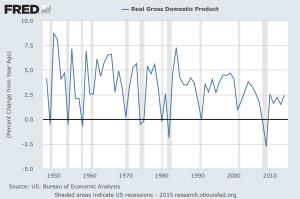

As we continue in the “new normal” of lower than trend growth in the Obama Era, last week saw 2.3% growth in the 2nd qtr after only a revised upward 0.6% in the 1st qtr, we must ask why. I have argued before that whether you are a progressive or a conservative, you ought to be in favor of higher growth.

There are of course many explanations of why we are in the “new normal,” not surprisingly in a social science which studies a complex system where ceteris is never paribus (things always changing, so hard to definitively identify cause and effect). My favorite explanation is that we have chosen a lower rate of growth by our policies–we have regime uncertainty. Entrepreneurs have enough problems trying to forecast future business conditions based on fickle consumers. When they have an ever-changing (and in our current times openly hostile) business climate, we shouldn’t be surprised when fixed business investment continues to lag. Of course it doesn’t help that with zero interest rates courtesy of the Fed, businesses have an incentive not to put money to work in the real economy by expanding their business, but rather to use borrowed (cheap) money to buy back shares.

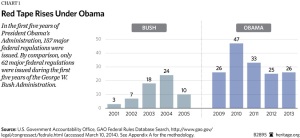

The Obama administration has given lip-service to pursuing growth policies, but this seems limited to “crony capitalism” private sector growth (such as with green energy) or to expanding the public sector through “infrastructure” spending. The Heritage Foundation suggested Mr. Obama was the biggest regulator ever last year, and he seems to be going faster:

Almost nowhere do we see incentives for all businesses to invest; indeed the only thing I can give the administration credit for is pursuing Trade Promotion Authority, but that is late in his administration. I guess better late than never. So what have we seen recently?

The Obama administration’s EPA will announce major new carbon regulations on Monday; even stiffer than previously announced. Here is Mr. Obama’s take on facebook. He insists climate change is fact, everyone agrees, and the world is getting warmer. Not able to get his agenda through the democratic process, he is implementing his regulatory regime by executive fiat. But as the WSJ reports, the goal is not just to reduce carbon footprint, we need to make sure we don’t do that via what is already happening in the market–the inexorable trend of switching to natural gas made possible by fracking.

The regulations also seek to prevent the electricity industry from becoming more dependent on natural gas, which burns 50% fewer carbon emissions than coal but still twice as much as zero-emitting sources such as wind, solar and nuclear power. Coal, which accounts for just under 40% of total U.S. electricity, emits the most carbon dioxide compared with other fuels.

But the EPA is just one source of regulatory pressure on the economy. Perhaps the biggest is with Dodd- Frank and its pressure on the banking system. Ostensibly written to rid us of too big too fail, it is having exactly the opposite effect: eliminating small community banks while leaving the remaining banks ever bigger. As if small community banks were the problem. In a WSJ article today, Mr. Vernon Hill, a former banker now starting a bank in the UK, remarks on how much easier it is to start a bank in the UK as compared to the U.S.

The result is that Dodd-Frank, a law intended to take on the systemic risk of “too-big-to-fail” banks, is multiplying the problem. “The big banks that are too big to fail are bigger now than ever, but the regulations have trickled down to the smaller banks that didn’t cause the financial crisis” Mr. Hill says. As a result, community banks are disappearing. “When I started my first bank in the 1970s there were 24,000 banks in America,” he says. “There are now 7,000 banks. It may soon be 500 or even fewer.”

“The regulatory environment has become so onerous in America that it is now easier to start a business in England than in the U.S.,”

Closer to home for us Bereans, the Department of Labor is proposing a new rule under the Fair Labor Standards Act which will raise the salary threshold of those employees that can be exempted from overtime. More businesses, and likely CU, will see more employees eligible for overtime. Of course this is to protect the workers, and there may be a case for this. Nevertheless, there is no free lunch–every cost that we as a university face will be paid by someone–almost certainly our students through higher tuition. So we complain about the costs of higher tuition, but at least part of this is due to the additional regulations driven by the government.

These are just examples I found over the last several days; the Federal Register is growing ever faster. We can complain about slow growth, higher costs, and higher tuition. But are we willing to constrain the regulatory state to solve these problems? The problem is that the low-hanging fruit is guarded by special-interest dragons.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach