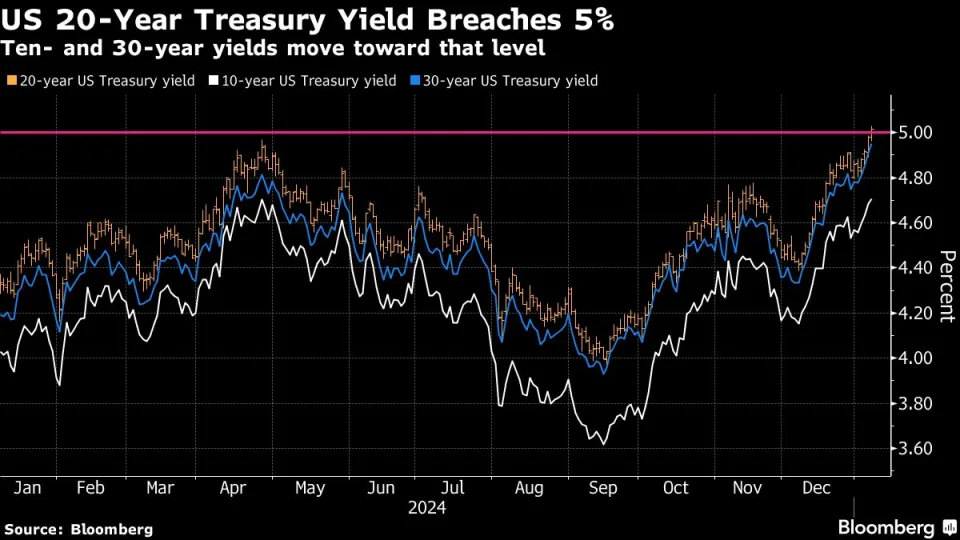

First up, as reported by Yahoo yesterday, and covered in the WSJ today is that long term interest rates continue to rise, with the 20 year U.S. Treasury over 5%, and the U.S. ten year going from 3.62% in the trough in September to 4.76% today. In Trumpian lingo, this is a HUUUUGE move up in rates! For those investing in bonds in the 2nd half of the year, you’ve likely been punished:

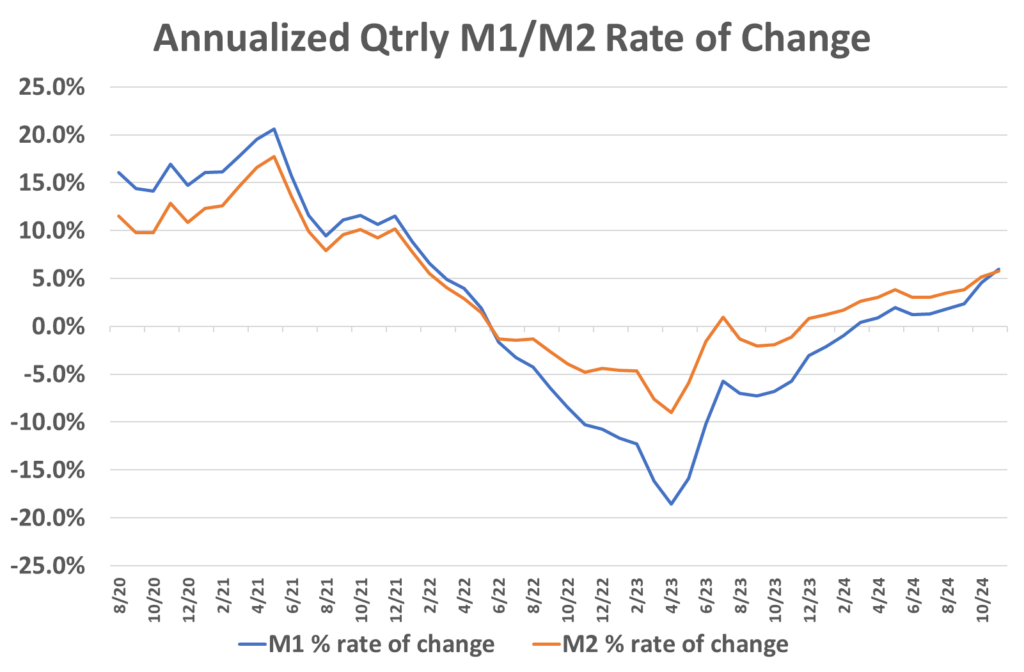

Interestingly, the move up in long term rates occurred right after the Fed reversed course and started lowering short term rates in its Sept 2024 meeting. It is a very rare thing for the Fed to lower rates and for long term rates to rise, and yet risen they have, rather dramatically. Is this the market saying that the Fed should have kept the higher rates longer? It certainly looks like the inflation rate isn’t cooperating with their 2% goal; the slide down appears to have stabilized at a rate closer to 3% and holding steady (core CPI over 3% for the last year, CPI-U (including food and energy at 2.7%). The Fed actually has been easing since the Silicon Valley Bank failure in Mar of 2023, and the money supply numbers continue to rise (albeit slowly, but hard to call that restrictive):

Perhaps the rise is simply optimism of robust growth in the expected (in Sep) and now here Trump II administration. Robust economic growth does lead to higher interest rates (interest rates are what we call pro-cyclical) as more firms have investment opportunities that they fund with debt. Increasing supply of bonds lowers their price, resulting in higher interest rates. Yet we also have increasing supply of bonds due to Uncle Sam’s profligacy, with the U.S. running just under a $2T deficit in the supposed great Biden economy, with $2T deficits as far as the eye can see. With Mr. Trump officially saying entitlements are off the table (the primary source of spending increase), DOGE has its work cut out for it.

Further Mr. Trump is ready to drill, baby, drill, but even before Mr. Biden’s colossally bad decision to 600M+ acres off limits for drilling, the markets weren’t showing a big drop in oil prices–quite the contrary, Markets don’t seem to believe Mr. Trump will be able to do much on oil prices, as reflected in futures markets; Jun ’26 crude is still priced at $68, when we’ve been hovering a bit above $70 for quite some time.

And then there is the possibility of the self-inflicted tariff wound. Challenges await the next administration.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach