Markets are in a panic on Monday morning early, with Dow Futures down ~1300 and oil down another 20% (over fear of an oil glut), with the Saudis and Russians in disagreement on oil production levels. With global supply chains in a bit of chaos with Coronavirus, global output is going down for this first quarter, and likely into the second (depending on when the virus abates) and clearly there is less need for the dominant form of energy–oil. Oil prices last week were down to low 40s per barrel, but Saudi Arabia moved to lower their prices further in a conflict with Russia, and markets have taken oil down to ~$32 as I write. Given the US is the world’s largest energy producer due to the fracking revolution, lower prices will harm our growth as well. So this week could be yet another an ugly market.

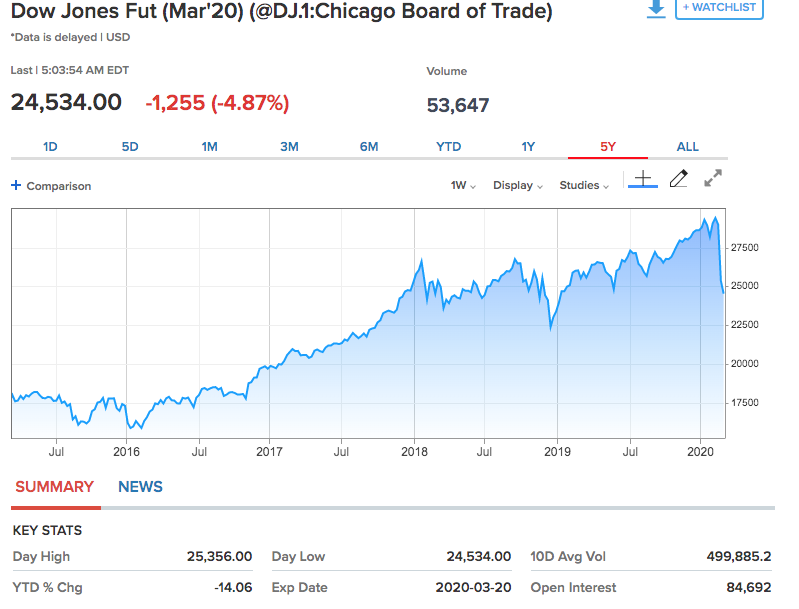

As we look at this market, with shocking absolute level changes (Dow Futures Down 1300!), I think its important to see this in the bigger picture. Take a look at the five year chart of the Dow Futures; this plunge only takes us back to where we were just a bit over a year ago, and just a bit below where we were just last summer. Markets more than tripled since the financial crisis, and we’re up about 60% since Mr. Trump took office prior to this downturn. News flash to all investors–you are now seeing that markets do not always go up. This is normal–what is abnormal is straight line up stock price increases and seemingly guaranteed returns. This is a real black swan event, and while black swan events are always going to cause significant market reaction, we are likely seeing an intensified reaction precisely because valuations were so high. And valuations were so high, not primarily because of earnings, but because of continuing global central bank monetary insanity.* When the Fed artificially restricts natural market downward movements with monetary policy (such that the market openly talks of the Fed put), yet provides the monetary juice to keep markets going ever higher, it creates the conditions for a large movement down when the unexpected happens.

The problem for government policy action is that all of our policy levers are built around Keynesian demand-side management. Either fiscal or monetary stimulus–that’s the only tool in the tool bag. So since you have a hammer, Coronavirus sure looks like a nail. The Fed’s emergency rate cut last week was totally ineffective, and late last week there were numerous calls for fiscal stimulus. Jason Furman, Mr. Obama’s Chairman of the Council of Economic Advisors, argued:

Given the mounting economic risks posed by the spread of the novel coronavirus, Congress should act swiftly but thoughtfully to pass fiscal stimulus. This would be in addition to continuing to provide ample funding for medical research, testing, prevention and treatment. The stimulus’s total cost would be about $350 billion, but could be larger or smaller depending on how the economic situation unfolds. Congress should design it to be accelerated, big, comprehensive and dynamic.

But this fiscal stimulus works through the demand-side of the economy, whereas the problem we face is primarily on the supply-side. Factories in China (and increasingly elsewhere) are shut down and global supply chains are disrupted–the problem at this time is not demand. Its true that it could be on the other side, and there will be an other side not too many weeks away, but given the underlying economic strength prior to this virus, as well as China’s almost certain “pedal to the metal” response you can expect after the virus is done, it seems too early to be panicking that we’re entering the next Great Depression.

Changing gears to the political fallout. I’ve opined that Mr. Trump was on path to reelection, yet with the Democrats walking away from the abyss of Bernie Sanders and coalescing around Mr. Biden, it’s now going to be more difficult for him. The Democrats’ immediate denunciation of Mr. Trump over the Coronavirus handling is obviously partisan, and hard to imagine Mr. Trump being blamed for a global pandemic (if it gets to that) that originated in China. Yet Mr. Trump’s reaction to the virus puts him in a difficult position–when he needs to appear sober and taking the Coronavirus as a serious and significant threat, he appears to minimize it. When he cites Johns Hopkins study that the US is the best prepared nation for a pandemic, that comes across as “we’re ready for it.” The same report denied that conclusion, as “”No country is fully prepared for epidemics or pandemics, and every country has important gaps to address.” It doesn’t help if we do do better than the rest of the world, but still have massive problems here. Now don’t misunderstand, I don’t think it’s going to be that bad, but my point is that for Mr. Trump, the only upside seems to be if we have almost no problem here–and almost no problem doesn’t seem to be a likely outcome. But if we have massive problems here, Democratic criticisms of the Trump administration will have more sticking power.

So despite the secular left’s denunciation of Mr. Pence’s leading the Trump team task force (he’s going to pray it away!), that is exactly what we need to be doing. Pray that God will guide all our leaders, and that he will allow His common grace to work through the scientists who are trying to come up with a vaccine, and that He will use this virus as a wake up call to those fearful of death. And each of us needs to have a heart of joy as we think about this–a confidence that is well placed will lead those fearful to wonder why you can be calm amidst the storm. We’re calm, not because “we’re the best prepared in the world,” but because perfect love casts out fear.

* When we have global central banks making a policy goal of a positive rate of inflation, when we have negative real interest rates as the U.S. policy in times of record low unemployment, when we have Trillions of dollars in global debt yielding less than zero–yes I call this monetary insanity.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach