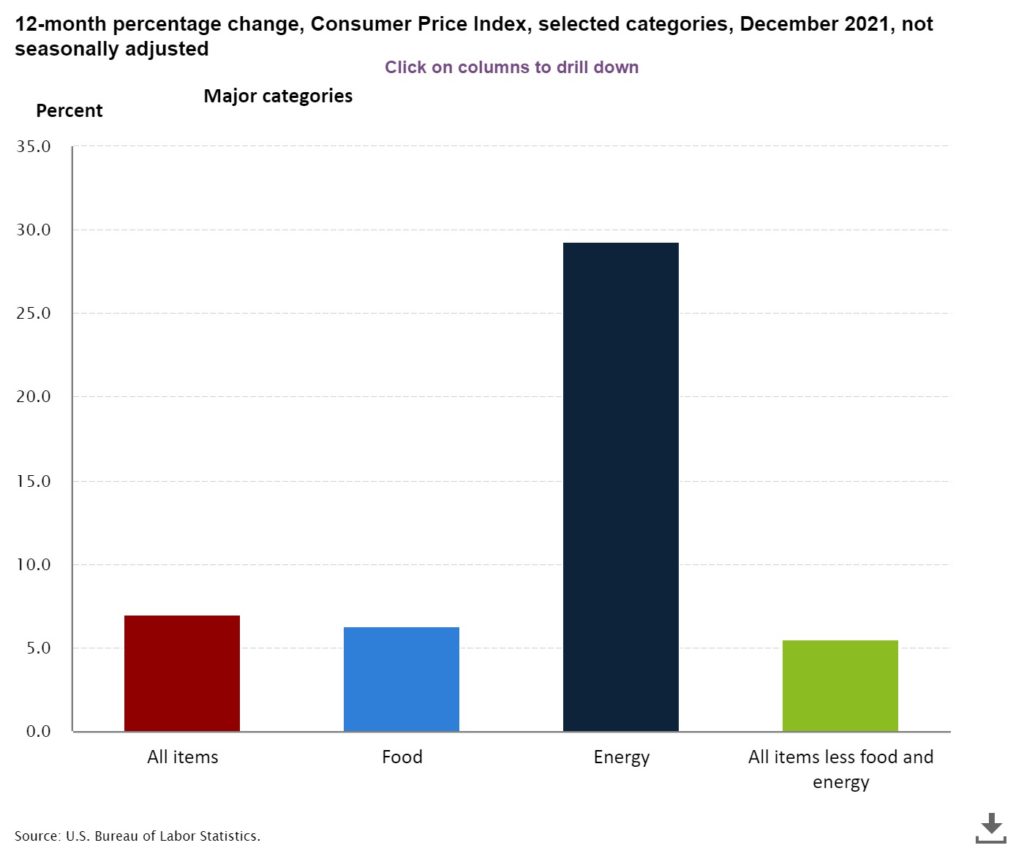

Today’s release of the Consumer Price Index (CPI) finally topped 7%, which is the highest rate since 1982, and if you applied the same index methodology used back in 1980, we have now slightly topped the 1980 experience. Yet the Biden Administration cannot acknowledge the reality of how their policies have led to this, as Mr. Biden categorically denied any possibility of inflation when pushing his agenda this summer:

Q It was on inflation. You mentioned unchecked inflation.

THE PRESIDENT: Yeah. There’s nobody suggesting there’s unchecked inflation on the way — no serious economist. That’s totally different.

It’s very interesting how anybody that disagrees with the Biden administration policy is “fringe” or not “serious.” The problem for the Biden Administration is that many prominent Democrats, including one very prominent economist, Larry Summers (Obama Treasury Secretary) have warned of this for months. Politically, I’ve suggested since inflation started perking up that the Biden Administration was playing with fire, and I suspect that fire is going to get much worse. Not on inflation (although it’s not likely to go down appreciably prior to the mid-terms absent some shock), but it appears that the Federal Reserve is preparing to actually do something about it. The stock market is not going to like this over the next 3-9 months, and the last thing the President needs is a major market correction prior to this fall’s election. Given the rich stock valuations the prior monetary ease has engendered, this could be particularly painful. Over the last decade the Fed has tried to reduce its balance sheet a few times, each time leading to a significant market correction, and ultimately forcing the Fed to back off. But now we have accelerating inflation. If markets respond quite negatively, will the Fed Put be dead or alive?

Given they can’t admit they’re wrong (why not?), the Biden Administration is now forced to scapegoat big business as greedily gouging consumers. Yet even the Washington Post editorial board condemns this economic ignorance:

There may be legitimate reasons to look carefully at these industries and how they operate, but pinning the current inflation problems on corporate greed is a flimsy argument that won’t stop Americans from beefing about inflation.

Just as in the Financial Crisis, the reflexive progressive response is to blame capitalist greed. This is particularly absurd as a causal explanation: businesses always want to make money and we should assume they will be as greedy as in their long term interests (at least, and occasionally in their short term interests). Since businesses are always “greedy” a causal explanation has to have a coherent story as to why greed just suddenly manifests itself? The WSJ has yet another satisfactory skewering of the Biden Administrations logic that beef companies are exploiting consumers:

“While their profits go up, the prices you see at the grocery stores go up commensurate and the prices farmers receive for the products they are bringing to market go down,” Mr. Biden said Monday. “This reflects the market being distorted by a lack of competition,” adding that “capitalism without competition isn’t capitalism; it’s exploitation.”

Thanks for the lecture, but back to Econ 101, Mr. President. Meat prices fell in the five years before the pandemic, and markets didn’t suddenly become less competitive. Like so much else in the Biden era, meat prices have soared amid surging demand, rising production costs and constrained supply.

Let’s look at that earnings report, which shows Tyson sold modestly less beef in the past fiscal year than in 2019. But Tyson executives noted during its earnings call that “customer demand” had “outpaced our ability to supply products” amid a severe labor shortage. One reason for this worker shortage is government pandemic transfer payments that subsidize leisure. At the same time demand for meat, and beef especially, has increased. During economic downturns, people typically buy less expensive protein. The opposite happened during the pandemic as incomes increased—also partly a result of expanded transfer payments—so people have had more money to spend on pricier cuts of meat.

Finally, take a note at the sharp rise in energy costs over the last twelve months. I don’t think it’s surprising to anyone that when the Biden Administration is pushing cabinet agencies to bankrupt the oil and gas industry that investment is going down, while demand is staying high. Greenflation is now here, and it’s likely to stay.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach