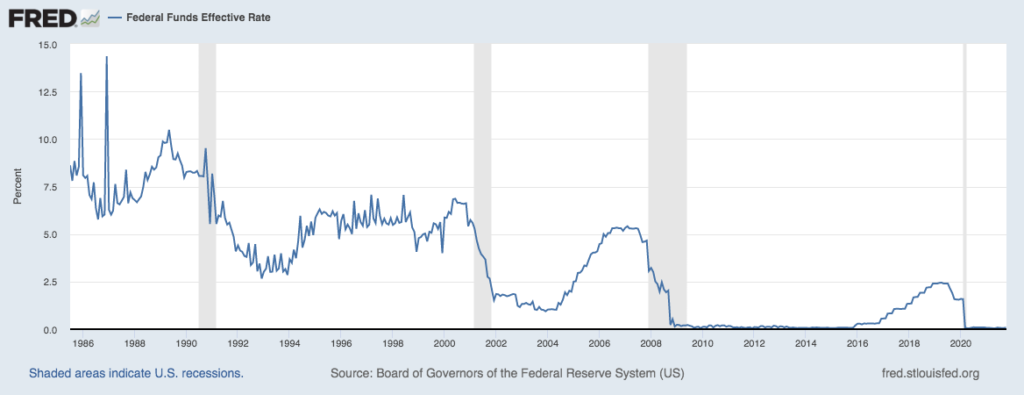

If you can’t stand the thought of your 401k being cut in half, then perhaps you ought not be in the stock market. It’s unfortunate, but the Federal Reserve has engineered asset prices to leave most investors with the Hobbesian choice of greatly overvalued stock and bond markets, or going with the money market opportunities earning a significant negative real yield. This Berean is a long-time critic of the Federal Reserve (and central banking more generally) as political pressures (even for so-called independent central banks) inevitably lead to lower interest rates and capital misallocation. The Fed’s policy in the early 2000s fueled the housing bubble, and the effectively zero interest rate policy in the aftermath of the financial crisis has led to hugely distorted asset prices.

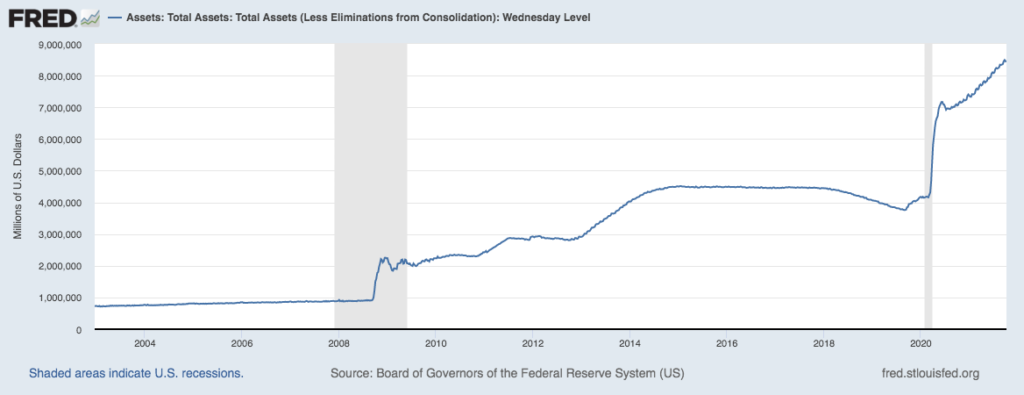

We’ve had over a decade with negative real rates of return, with a brief window of breaking even in the Trump administration, from which the Fed quickly capitulated in response to Mr. Trump and the stock market’s displeasure. The Covid-19 crisis led the Fed to directly monetizing large parts of the mortgage and Treasury markets, with the Fed over doubling its balance sheet, and they are still buying $120B in assets per month! The Fed has expanded the supply of reserves to the financial system by 10X since before the financial crisis!

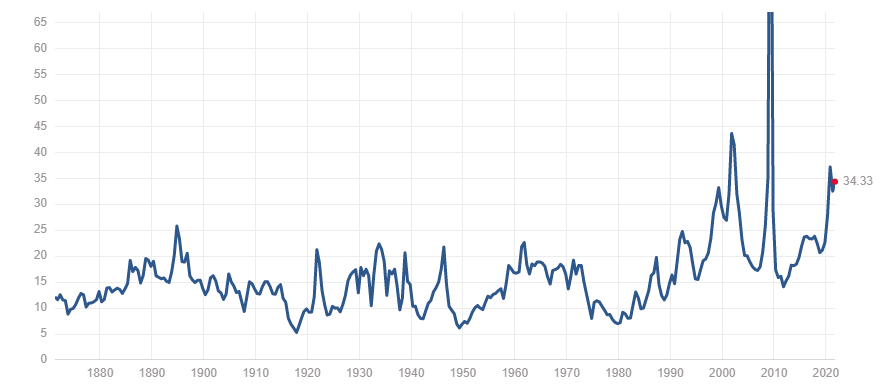

The Fed sterilized much of the early increase of reserves in the early part of last decade, but nevertheless the stock market over tripled in that decade, and we have all seen the insane market reaction to over $4T in Federal Reserve debt monetization since the onset of the pandemic. As the first chart above shows, the stock market (S&P500) price-earnings ratio (one of the most common valuation metrics) shows that our current stock market boom is more richly valued than anytime in history while still in the bull phase.* Now value investors have been slaughtered (relatively) for two decades, as low interest rates favor growth over value, but we are still at extreme highs. And it is difficult to see future earnings growth justifying these valuations absent Federal Reserve (and the complex of global central banks) market manipulation. It’s not just me saying this, although I’m more the critic–pretty much every market observer knows the Fed has the market pumped up. Jeremy Seigel of Wharton noted this in projecting a more significant harm than others expect if the Fed tightens due to inflation:

“We all know that a lot of the levity of the equity market is related to the liquidity that the Fed has provided. If that’s going to be taken away faster, that also means that interest rate hikes are going to occur sooner,” he noted. “Both those things are not positives for the equity market.”

This points to the other negative aspect of asset inflation: it leaves the system much more vulnerable to a significant correction should any exogenous shock occur. Now the threat of inflation should correctly be seen as an endogenous shock (i.e., it arises precisely from the same monetary forces which drive asset prices higher), but exogenous shocks like the political football of the debt default are also possible. While I continue to maintain that the “end of the world” language (if Republicans don’t agree to keep going in debt) was much more than hyperbole, but rather deliberate fear-mongering, it is true that with elevated stock prices any particular thing could be the proverbial “straw that broke the camel’s back.”

Historical average PE ratios would be under half our current level, and bear market lows could have 75% of current market rates. This isn’t a call for you to do anything, other than be aware that Fed policies have made markets much more volatile. If you can’t handle them going down 50% from current levels, you shouldn’t be in the stock market. Because historically, that’s where they’ve been, and are only where they are now due to Federal Reserve policies. Will those policies change? It all depends on inflation, which the Biden administration continues to foment with its policies. But more on that with a series of upcoming posts on inflation.

* The chart does illustrate two higher peaks after the tech bubble crashed and the financial crisis hit. The reason is that for short periods earnings can collapse even more rapidly than stock prices, leaving the ratio higher.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach