As I’ve shared before, I am excited by some of Mr. Trump’s economic agenda, and his executive orders even this week on regulation are a great first step toward unleashing the American economy. When I consider our budget issues going forward, the best way to enable any other necessary change is for faster economic growth. Yet what he gives with one hand, Mr. Trump threatens with the other in his views on trade.

Mr. Trump prefers businessmen to economists, which might be o.k. if his businessmen had a good grasp of basic economics, but he has chosen people that generally go with his nationalistic agenda–which is really just a revival of the mercantilist doctrine that Adam Smith crushed in his An Inquiry into the Nature and Causes of the Wealth of Nations. Since Smith, economics has demonstrated both theoretically and empirically that voluntary trade always benefits both parties. This is true of economists on both the left and the right; consider Former Vice Chair of the Fed, Professor Alan Blinder, who is on the left side of the economic and political spectrum:

In running our personal affairs, virtually all of us exploit the advantages of free trade and comparative advantage without thinking twice. For example, many of us have our shirts laundered at professional cleaners rather than wash and iron them ourselves. Anyone who advised us to “protect” ourselves from the “unfair competition” of low-paid laundry workers by doing our own wash would be thought looney.

Yet Mr. Trump continues with the economic fallacy that an increase in exports is the way to increase the wealth of nations. So this week one of the major controversies is his administration’s possible proposal to count goods that come in for re-export as imports only while not counting them as exports. The sole purpose of this is to make the trade deficit appear worse, in order to justify his view that we are “losing” on trade deals. This is really economic quackery, for multiple reasons. First, I could sort of understand not wanting to count the net exports as contributing to the economy since the goods were not originally produced here. But to count them as imports without counting them also as exports is totally bogus. Yet there is a more fundamental point about re-exports, which shows the basic economic ignorance of the administration. Why do the goods come into the U.S. in the first place? Other countries are not going to ship goods through the United States to get to another country unless it provides some net benefit. That very fact is demonstrative that the U.S. adds value to the goods re-exported, which is therefore properly accounted as our contribution via the Net Export category of our GDP calculations. Trumpian logic would be no different than saying we shouldn’t consider Walmart’s sales as part of our economy, since they only re-export goods that someone else produced. If Walmart adds value to the process (and indeed they do), then so does the resident U.S. “re-exporter.”

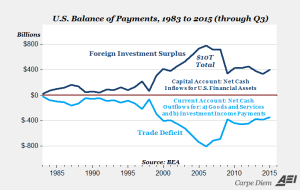

Yet we also can’t ignore his ignorance about the trade deficit itself, assuming a trade deficit with an individual country is bad. So what if we have a merchandise trade deficit with an individual country? Why would it matter if we had a $500B deficit with China, if we had a surplus of $500B with Europe? I run a huge trade deficit with Walmart and Costco locally; I keep buying goods from them and they never buy anything from me. I must really be a “loser” in my trade with Costco. But I run a continual trade surplus with my students; they keep buying my economic training but I’m never willing to buy any of their output! But of course even that is meaningless; even if we had no surplus with any other nation, but had an overall trade deficit, that does not necessarily indicate any problem, since by necessity our trade deficit must be offset by a capital account surplus. If countries like China do not take the dollars we give them and turn around and buy our goods, they will use those dollars to invest in our country. Attracting foreign capital is generally a very good thing, and countries that allow the free flow of capital do significantly better than those that do not. As just one example close to home, the Chinese-owned Fuyao Glass Company now employs about 2000 people in Dayton in the old GM Moraine plant. These are manufacturing jobs that Mr. Trump claims to love. So what’s the problem?

And here is the kicker: Since the balance of payments must balance, and the capital account (labeled as Foreign Investment Surplus below) will be offset by the current account (roughly the trade deficit), Mr. Trumps policies are therefore mutually exclusive. He wants to make America great again with a stronger economy, and to the extent he succeeds that’s going to attract foreign capital (as America will be comparatively a better place to invest). But that capital inflow will lead inevitably to an increase in the trade deficit.* This isn’t ideology, this is simple accounting.

I propose an alternative path for Mr. Trump: Let the millions of Americans decide who they want to trade with, rather than centrally directing that choice from Washington DC to benefit favored cronyists in the U.S.

*Ignoring the possible offsets the central bank could make to sterilize any currency flow through a change in official reserves–something that can’t do much over the long term anyway.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach