Financial markets are on edge with Greece this a.m., as Greece banks are closed and there will be a referendum to get public permission from Mr. Tsipras to break his electoral promise and impose austerity conditions to get more aid from the Europeans. As a Euro skeptic from the beginning, I wonder when the charade of a common currency will end. The Eurocrats dream was that a common currency would drive a common Europe and make them a common people. But these are still very different countries with different cultures and attitudes toward work. How long will the Germans subsidize the idle Greeks?

Closer to home, we see that a similar implausible payback is finally being recognized in Puerto Rico, whose governor admitted in a CNBC report that they will have to restructure the debt (over $72B).

Puerto Rico’s governor, saying he needs to pull the island out of a “death spiral,” has concluded that the commonwealth cannot pay its roughly $72 billion in debts, an admission that will probably have wide-reaching financial repercussions. The governor, Alejandro García Padilla, and senior members of his staff said in an interview last week that they would probably seek significant concessions from as many as all of the island’s creditors, which could include deferring some debt payments for as long as five years or extending the timetable for repayment.

“The debt is not payable,” Mr. García Padilla said. “There is no other option. I would love to have an easier option. This is not politics, this is math.” It is a startling admission from the governor of an island of 3.6 million people, which has piled on more municipal bond debt per capita than any American state.

So why do we care about Greece or Puerto Rico? After all, they are both small economies relative to the world and their larger trading partners? While it is regrettable that their population will suffer, they did bring it on themselves with profligate spending. What’s the deal?

In one sense I could agree with this–the principle of sowing and reaping is well at hand here. And the burned hand does teach best; maybe this can be an object lesson for larger countries? Unfortunately there may be larger implications when leveraged speculators are counting on bailouts–crony capitalism is well at work here: certainly in Greece and likely Puerto Rico. So stock markets today are holding their breath and gold is getting a bit of a safe haven bid.

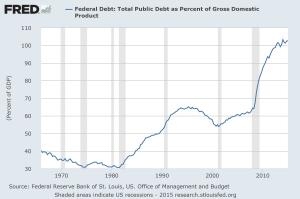

But the bigger problem is the U.S. continues to ignore the problem. Greece? What Greece? What Illinois, Detroit, Puerto Rico, Vallejo, etc.? And there is some truth to this–especially when you can always print more of what you’ve promised to pay. But at the end of the day, as Mr. Padilla says, this is not politics, this is math. One of the basic problems of our sinful condition is the desire to live for today and to put off pain till tomorrow. Living in light of the gospel means living with eternity in mind, but in our flesh we live for the day. So pile on the debt! Eat, drink, and be merry! But we will reap what we sow. Just ask Greeks if they like what is happening this week. Coming to a U.S. near you if present trends continue.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach