Proverb 22:7 tells us: “The rich rules over the poor, and the borrower is the slave of the lender.” Most contemporary translations render ébed “slave” as with the ESV here. The predominant translation of ébed in the King James version is “servant”. In Hebrew culture an ébed was commonly a slave, however, given the connotation and meaning of the word slave in 21st century America, servant may may shed more light on the original meaning of ébed. An ébed was a servant of servants – the lowest servant. An ébed might be a servant of a king, his ministers, or a captain – an ébed was subservient to someone above him. “The Hebrews, in speaking to superiors, either from modesty or else lowly adulation, call themselves servants and those to whom they speak lords” (Gesenius’ Hebrew-Chaldee Lexicon in the Blue Letter Bible). ´Ebed is derived from ʻâbad, the word used in Genesis 2:15 to describe humanity’s pre-fall mandate to cultivate or work in the garden of Eden. Service is foundational to understanding the concept and coupled with the notion of serving a superior there is an implicit idea of worship. So while the contemporary understanding of the word “slave” might be too strong, ébed definitely means working for and to an extent being controlled by a superior. “The borrower is the servant of the lender” and must submit to the lender’s control.

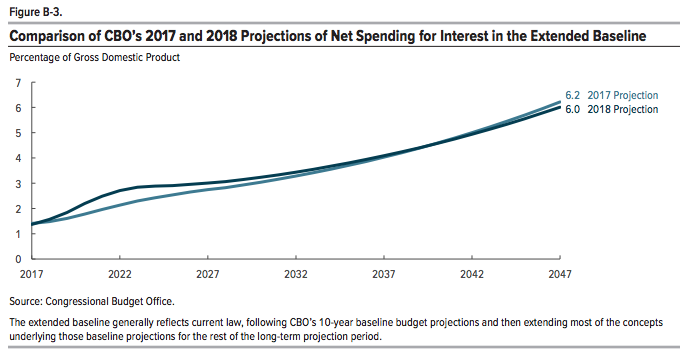

The United States government it is about to see this principle played out over the next several years. As the federal budget deficit continues, debt accumulates, and interest rates rise the amount of our government pays on its debt will increased dramatically.Outlays for net interest rose 20% in fiscal 2018. The US Treasury reports it will issue twice as much debt in 2018 as it did in 2017. This is because not only are budget deficits continuing to balloon, but also is the result of the recent tax cuts. In June, The Congressional Budget Office released The 2018 Long-Term Budget Outlook. Over the next 10 years, interest payments are predicted to increase by almost 250%. The following graph illustrates the CBO’s prediction for interest payments over the next 10 years.

Along that path, the government is expected to pass the following milestones: It will spend more on interest than it spends on Medicaid in 2020; more in 2023 than it spends on national defense; and more in 2025 than it spends on all nondefense discretionary programs combined, from funding for national parks to scientific research, to health care and education, to the court system and infrastructure, according to the CBO (U.S. on a Course to Spend More on Debt Than defense).

Solomon knew that borrowing and debt have an effect on the lender. Those in debt have their options restricted. While there are differences in the budgetary restraints and possibilities of a 21st-century welfare state compared to whom Solomon envisioned as his audience when he wrote Proverbs, the basic principle is the same. “The borrower is the servant of the lender.”

Send questions to mailbag.bereans@gmail.com.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach