“But woe to you, scribes and Pharisees, hypocrites, because you shut off the kingdom of heaven from people; for you do not enter in yourselves, nor do you allow those who are entering to go in.

When I think about this verse from Matthew 23 of the Eight Woes, I can’t help but see some applicability to economists such as Nobel Laureate Paul Krugman. Not only will Professor Krugman not embrace good economics, but he’s doing his best to ensure others don’t understand good economics either, by making ad hominem attacks on those who support Austrian Economics. Now there are whole blogs devoted just to addressing his economic fallacies, but I’d like to add a few thoughts with respect to Mr. Krugman.

First, in a recent article, he suggests followers of Austrian Economics are like followers of a cult, since

the failure of prophecy — in this case, the prophecy of soaring inflation from deficits and monetary expansion — only strengthens the determination of the faithful to uphold the faith.

Of course, Mr. Krugman, is always willing to change his mind when a prophecy doesn’t work–right? Like when he was dead wrong on predicting disaster for Latvia for its “austerity” program? Think again.

But for my second point, let’s address Mr. Krugman’s somewhat valid critique that the inflation Austrian’s have predicted has not occurred. On the surface, doesn’t that prove that Austrian economics is wrong? In short, no. Because as usual, Mr. Krugman attacks a straw man, and does not address the heart of Austrian business cycle theory. The main point of this theory is that lowering the interest rate below the “natural” rate of interest sends signals to entrepreneurs that present goods are relatively lower valued, while future goods are relatively higher valued. Thus entrepreneurs find that longer, more “roundabout” production techniques are financially viable and will steer capital away from a structure of production that supports true consumer preferences. Capital directed away from projects supporting true time preferences for consumption is called malinvestment, because it is only sustainable as long as the interest rate stays lower than the natural rate, which can only occur as additional money is created. Because consumer preferences have not changed, the demand for current consumer goods has not changed, and the competition for resources will lead to increased prices. Eventually the Fed will have to pull the punchbowl away or we’ll have Mises’ “crack up boom”.

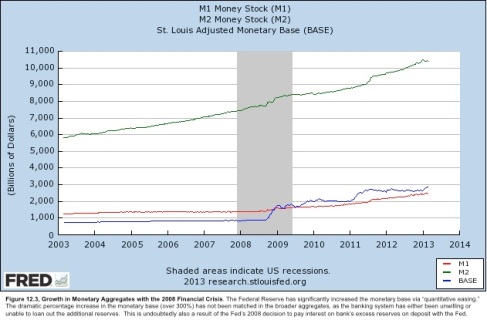

So given the massive increase in the Monetary Base and negative real interest rates, where is the inflation? Several ways to answer this. First, and most important, Austrian theory is far less concerned with inflation per se than the malinvestment that ultimately leads to inflation. There is nothing in Austrian theory which suggests a CPI-based indication of inflation is going to occur in six months or six years. This is, in part, because Austrian theory very carefully understands inflation to affect different goods in different ways–consumer goods will usually be the last to see inflation; the higher order capital goods which the increased money supply purchases will see inflation sooner. So what has the malinvestment principally funded this time? Not real estate, or a tech bubble, but a Treasury bubble. Malinvestment of epic proportions has funded a massive increase in our national debt. Second, while M1/M2 have risen quite a bit, we actually have a lower level of M1 than the Monetary Base! What happened? Since the Fed pays a small amount of interest on reserves (initially .75% in 2008, but now only .25%), there is less of an opportunity cost of holding cash, when banks basically pay nothing for cash. For a wide variety of potential reasons (regime uncertainty, interest on reserves, lack of profitable investment opportunities, etc.) banks have not aggressively loaned out the money and hence consumer prices are not under significant pressure….yet. Nevertheless, we have had malinvestment and only time will tell how this bubble will burst and what the implications are.

Since Mr. Krugman cares so much about the poor, and really seems to want to help educate misguided Austrians, perhaps he ought to consider debating Austrian economist Robert Murphy, who through donations is up to $60,000 to the foodbank of Mr. Krugman’s choice, just to show up. Think he’ll do it? Call me doubting Thomas…

Since Mr. Krugman cares so much about the poor, and really seems to want to help educate misguided Austrians, perhaps he ought to consider debating Austrian economist Robert Murphy, who through donations is up to $60,000 to the foodbank of Mr. Krugman’s choice, just to show up. Think he’ll do it? Call me doubting Thomas…

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach