Lots of press the last few days on the markets crashing, with the first stock market correction since 2011. I’ve been warning that this won’t end well, but that doesn’t mean I have the answer to what happens next–if I did I would be making the trades first thing tomorrow to profit from it myself. As is often said, he who lives by the crystal ball eats lots of broken glass.

Nevertheless, there are some things we know. Central banks worldwide have expanded their balance sheets in an unprecedented manner since the financial crisis, with interest rates at a sustained low rate that belies the risk inherent in markets. Some of that risk is now being priced in. I do believe we are in a bubble, and the effect of the bubble is primarily investment in uneconomic enterprises, whether it be Greek or U.S. bonds, or in Chinese cities where no one lives.

The usual method for bubbles to burst is through the central bank panicking due to rising consumer prices, and raising interest rates. Many of the projects formerly profitable only due to low interest rates are then shown to be malinvestment, and the bust soon follows. I’ve been concerned since the end of QE3 that the lack of additional monetary stimulus would result in the bubble bursting. But this end of stimulus was more than offset by the Japanese monetary stimulus and the European central bank’s as well. Nevertheless, there are cracks in emerging markets, as hot money is leaving in anticipation of higher rates in the U.S. The dollar index is still ~20% higher than a year ago; that is a monster move in currency terms. China has seen its currency appreciate significantly against its Asian competitors concurrent with the dollar’s rise. All of this is systematic of global “imbalances” due to central bank monetary manipulation. And what has all this central bank ease resulted in? As the WSJ opines:

One lesson here is that the Fed’s great monetary experiment since the recession ended in 2009 looks increasingly like a failure. Recall the Fed’s theory that quantitative easing (bond buying) and near-zero interest rates would lift financial assets, which in turn would lift the real economy. But while stocks have soared, as have speculative assets like junk bonds and commercial real estate, the real economy hasn’t. This remains the worst economic recovery by far since World War II, and we’ll be watching to see if financial assets now fall to match the slow real economy.

Markets in Asia continue to fall on Sunday night, and financial conditions are tightening in the shadow banking system, independent of whether the Fed raises rates or not. China is allowing their state pension funds to buy into the market, potentially bringing almost $100B into the market, with additional monetary stimulus in works. So I’ll step out on a limb, getting ready for my meal of broken glass. The Fed does not want to back off their promise to raise rates, but I think they will. In fact, should the market have a strong correction, I expect the next move will be additional monetary stimulus–“QE4”, whatever they call it. Should I be wrong, and the Fed actually increases interest rates, I expect a major debacle, with stock markets crashing. Of course, whether either of these realities hit, or something else happens, the interesting thing is that so much of what happens next is dependent upon central banks and how much money they print, along with how much stimulus governments will provide. That alone should be disconcerting. Make no mistake, we are a long way from a free market economy. Keep your crash helmet on.

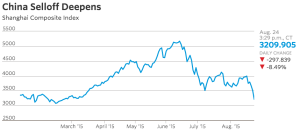

EDIT Update Monday morning. Waking up to China’s market down 8% and Dow futures off significantly. Headline from WSJ this a.m. is “China to Flood Economy with cash.” Chinese stocks are now down 40% from their rapid growth earlier this year.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach