One of the bright spots in the U.S. economy over the last decade was the incredible technology revolution in the energy sector with hydraulic fracturing, or “fracking.” The U.S. energy revolution drove the nail through the heart of economic pessimists claiming that we’d hit “peak oil,” and were doomed to run out of cheap fossil fuels. Instead, the fracking revolution happened and the U.S. is now the largest producer of oil and natural gas in the world–yes we’re Saudi America! Even the regulatory state couldn’t stop it, since almost all the major activity happened on private land.

And even better than the technology itself, is what the technology means to the cost to develop oil. While U.S. production is more expensive than some countries, the cost to develop a well and bring production online is very low, and very quick. Instead of billions of dollars and decades to develop large fields in difficult places, fracking can bring production online in only a few months at less than $10M.

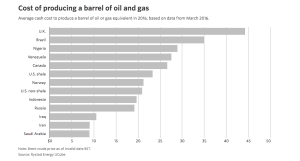

The Saudi’s didn’t take this upstart attacking their cartel well, and in 2014 declared war on U.S. frackers, since the Saudis had the lowest cost of production. They hoped to drive the higher cost Americans out of business, and then resume their rightful place as the oil price maker. The price of oil dropped at one point down to ~$30/barrel, well below the average break-even cost of U.S. fracking (~$60/barrel when the OPEC war on fracking started). But a funny thing happened along the way; U.S. fracking production costs started falling–marginal producers fell out, but others began driving costs down further and became more efficient–learning to make money at even $40/barrel. As the oil company BP noted,

The key point here is that the nature of fracking is far more akin to a standardised, repeated, manufacturing-like process, rather than the oneoff, large-scale engineering projects that characterise many conventional oil projects. The same rigs are used to drill multiple wells using the same processes in similar locations. And, as with many repeated manufacturing processes, fracking is generating strong productivity gains.

Meanwhile, rather than the U.S. crying uncle, it was all the despotic regimes that have based their economies around oil (many of which needed $100/barrel oil to run their governments, and Venezuela is so bad it needs $200/barrel to run their socialist paradise!). So this week OPEC announced that they were able to gain agreement with non-OPEC countries to curtail production. But its too little, too late.

OPEC nations need higher oil prices to balance their budgets. The cartel has been negotiating to cut oil supplies and drive up prices. But there’s a catch. Deal or no deal, OPEC will still have to accomodate America’s oil frackers. They’re not OPEC members, and would jump to lock in higher prices. Texas oil men say $60 oil would spur a new drilling boom, negate the effect of any OPEC cut, and steal the cartel’s market share and revenues.

Cartels, like monopolies, are attempts to exploit consumers to serve the interests of producers. Not being content with a producer surplus, cartels want to extract as much of the consumer surplus as possible. Rather than cooperating in mutually beneficial exchange (as with a competitive market), cartels view customers as sheep to be shorn. Fortunately, cartels are notoriously difficult to maintain, as there is always a tendency to cheat. OPEC has often had that problem. But the ultimate cheater is the outsider. Cartels are only possible with few players, but fracking is unleashing hundreds and thousands of small drillers just waiting for an opportunistic price point to enter the fray. Yes, the king is dead. Long live the king!!

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach