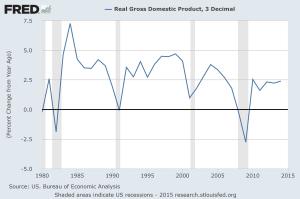

Last Friday’s GDP number was horrible–a contraction of -0.7%; the revision down from an initial estimate of -0.2%. This is in stark contrast to the Obama administration crowing over 3rd qtr 2014 GDP #s, which were over 5%–so we were told that the corner had finally been turned. The administration and its defenders are quick to point out calculation issues that are problematic, and indeed the sharp rise of the dollar and the West Coast port shutdown did significantly slow down trade. Yet all this misses the broader point–growth is pathetic and we are in Mr. Obama’s 7th year. The recession was officially over in 2009, and we have yet to see a year better than 2.5% growth! It’s a generally good rule of thumb that we need economic growth of 3%/year to generate significant job and income growth. When you compound this lower performance over time, the effect is quite dramatic.

Perhaps you believe in the “secular stagnation” theories–we’re now in a new normal of low growth. I don’t buy it. I’m still a fan of Occam’s Razor, which basically says if you have two ways of explaining something with equal accuracy, go with the simplest explanation. We don’t need new theories of secular stagnation–the attack on the “supply side” via regulatory and fiscal uncertainty seems large enough to explain the slower growth we now see. Likewise, economist Casey Mulligan has voluminous data to show that slow job growth can be explained by the changes to incentives that affect microeconomic behavior. The bottom line: bad public policy is at least a large part of the bad results. Any explanations of “secular stagnation” or problems calculating GDP are in many cases simply an attempt to muddy the waters. Mr. Obama has pushed for policies that reduce opportunity for all–will we ever say enough?

So what are the implications of slow growth? Well, growth is really the only cure for all our fiscal ills; the only way to reduce the burden of the debt without draconian reductions in spending or promises made. It’s also the only way to raise real median wages. Sure we can keep the printing presses on and drive up stock prices due to Fed-induced asset inflation. But that doesn’t help the poor. What the poor need are opportunities–and opportunity will only increase with growth. To me its easy: if you are a progressive or a conservative, we all ought to agree that we need policies to stimulate growth.

EDIT Update 6/2/2015: Today one Fed Governor is saying 2nd qtr GDP isn’t looking to rebound much based on early data the Fed is looking at–this is not just “one bad qtr”.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach