PIMCO’s Bill Gross came out swinging today against European austerity today, this after reports that Reinhart and Rogoff’s well-regarded work on debt had some statistical errors on the danger of debt. So today Mr. Gross told the FT,

“The U.K. and almost all of Europe have erred in terms of believing that austerity, fiscal austerity in the short term, is the way to produce real growth. It is not,” Mr Gross told the Financial Times. “You’ve got to spend money.”

This, of course, has that “prophet of profligacy,” Professor Krugman, crowing:

The point is that the next time Olli Rehn, or George Osborne, or Paul Ryan declares, sententiously, that we must have austerity because serious economists (i.e., not Krugman and friends) tell us that debt is a terrible thing, people in the audience will snicker — which they should have been doing all along, but now it has become socially acceptable.

Sorry to be a broken record, but the debate is not over stimulus vs. austerity, it is a debate over what sector of the economy should be stimulated and what sector should suffer austerity. Of course, Europe has made mistakes. In many of the countries they have had austerity combining significant tax hikes as well as govt spending cuts. To throw austerity on every sector of the economy does not seem to be a way to grow your way out of the economy–and growth is indeed the only cure to what ails us. But as Alesina’s work has shown, countries that have austerity via government spending cuts instead of by tax increases are significantly less likely to have a recession, while stimulus via tax cuts provides a larger “multiplier” than does government spending. So to reiterate, in a world where many nations are threatened by fiscal crisis with high debt levels, we need austerity on the public sector and stimulus on the private sector.

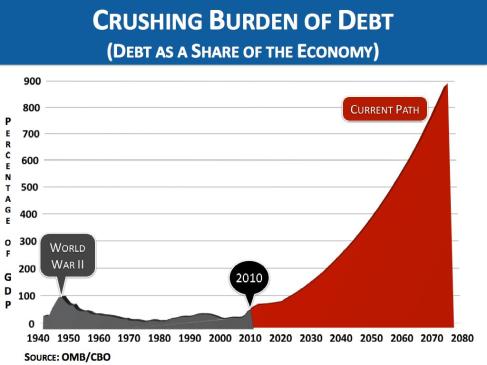

And just a couple of thoughts on the statistical error by R&R. First, this is one small part of the overall data tour-de-force that R&R assembled–as if this one error nullifies the overall analysis. Second, let’s just assume it does. So debt-to-GDP levels of 90% do not lead to lower growth. Would anyone deny that at some point there is a “tipping point”? So maybe its not 90%; but we’re already @ 100% here in the U.S.–with an incredibly risky trajectory. If and when interest rates rise (either due to inflation expectations or renewed growth), we will already in significant distress even with today’s debt levels. Do we really want to cavalierly say debt is no problem, as Mr. Krugman avers?

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach