This is America Saves week.

If there was one encouraging result from the “Great Recession” it was that personal savings increased. However it looks like that trend has reversed itself and we are returning to our accustomed low rates of saving. In a post in Real Time Economics on the Wall Street Journal’s site Jeffrey Sparshott gave some information from a survey released earlier in the week.

A new survey released Monday found that only 68% of all Americans are spending less than they earn and saving the difference. That’s down from 73% in 2010, the first full calendar year after the recession ended. Some 64% of households have emergency funds, down from 71% in 2010. The survey found 76% are reducing their consumer debt, down from 79% in 2010.

We know that saving is a necessary part of good stewardship. Proverbs 21:20 says “precious treasure and oil are in a wise man’s dwelling, but a foolish man devours it” (ESV). The New Living Translation renders this verse “The wise have wealth and luxury, but fools spend whatever they get” (NLT). Saving is part of good stewardship that focuses on a productive economy. Spending more than your means is associated with a view of economics, that while very popular, is not sustainable into the longer run. You simply cannot consume more than you produce. We may think we can, as we borrow from future wealth to consume today and as the government continually spends more than it takes in in revenue and as the Federal Reserve pumps liquidity into the global economy, but sometime the “joyride” will end.

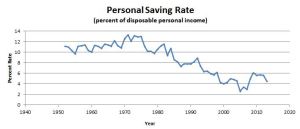

Let’s look at this reported decline in saving in a longer-term context. The diagram below is created from data provided by the Bureau of Economic Analysis for the years 1952 through 2013.

You can clearly see saving declining from the mid 1970s until the time of the Great Recession. There is an upward spike in personal saving during the recession and and you can see the savings decline reported in the current survey in that last downtick on the graph. Examined in this longer term perspective, the increase in savings that was a result of the Great Recession appears to be an anomaly in a long-term trend of lower saving rates.

We can’t really expect our federal government to spend within it’s means if a large number of its citizens do not. Perhaps the issue with the national debt and continual deficit spending is more of a problem with our individual and collective economic character – our representatives do represent us. If we want our government to repair its financial house perhaps we should repair ours first.

Bert Wheeler

Bert Wheeler

Jeff Haymond

Jeff Haymond

Marc Clauson

Marc Clauson

Mark Caleb Smith

Mark Caleb Smith

Tom Mach

Tom Mach